5-Star Diversity, Equity and Inclusion

Jump to winners | Jump to methodology

Bringing people together

Ground zero for the social justice uprisings of 2020, the United States continues to make great strides in advancing diversity, equity and inclusion (DEI) in the workplace. In particular, the insurance sector leads DEI efforts in North America’s financial services industry, but there’s still a long way to go.

“Insurance continues to lead in gender diversity in the entry-level workforce, where 66% are women — though these women are predominantly white,” says a recent report by McKinsey & Company. The report also shows that the greater number of women at entry level is mostly due to the larger, more diverse workforces employed by call centers and field-claims organizations in insurance. Black women account for more than 7% of the entry-level workforce – the highest rate in financial services – but the number drops along the corporate ladder, down to zero at the C-suite.

“Greater awareness, psychological safety at work, and the imperative of diversity and inclusion have been amplified, but there’s still more work to be done”

Michele Lamarre, QBE Insurance

The time to act

For Jani Groza, corporate responsibility and diversity officer at Westfield Insurance, a winner of Insurance Business America’s 5-Star Diversity, Equity and Inclusion award, the last several years have shone a light on racial inequities throughout the world and highlighted the need to carefully consider how companies address and navigate DEI at work.

“Intention is not enough,” she says. “Now, it’s about committing and demonstrating measurable action to reduce barriers.

“At Westfield, we have been on this journey for more than a decade. So, at the time of the social unrest, we were in a place where we were building. We had already invested considerable time assessing our existing strategies, yet we paused and asked ourselves, ‘Are we doing enough and in what areas can we do more to stand in support of ending systemic racism?’ For those who had not started their journey, it was the impetus to begin because the biggest mistake would be inaction.”

Groza’s concerns are echoed by Michele Lamarre, head of diversity, inclusion and belonging at QBE North America, another 5-Star DEI winner. “The national efforts have made some progress over the past few years. Greater awareness, psychological safety at work, and the business imperative of diversity and inclusion have been amplified. There’s still much more work to be done, though.”

She says that increasing diversity but not incorporating inclusion and belonging is a limited view that could result in a failed strategy.

“The hurdle of solely focusing on increasing representation of a diverse workforce is deceptive where representation may be great, but creating an environment where this diverse workforce can thrive and feel like they belong is even more vital,” Lamarre says.

Gail Wien, head of people engagement at AXIS Capital, another 5-Star DEI awardee, also emphasizes the work yet to be done.

“We recognized that we had to set goals to achieve meaningful progress in gender and ethnicity representation at the most senior levels of the organization,” she says. “We also recognized we are competing with other organizations within and outside of our industry to attract diverse talent and retain the talent we currently have, which is in high demand.”

“Intention is not enough. Now, it’s about committing and demonstrating measurable action to reduce barriers”

Jani Groza, Westfield Insurance

Clear objectives

To get to where it is today, AXIS has established a strong DEI foundation based on employee input. The company has engaged executive support for DEI initiatives, including a commitment to setting and reporting long-term goals. Career development initiatives have also been launched for a workforce with a diverse background.

Meanwhile, Groza says that in response to the social unrest, “[Westfield] made a public statement where we committed to doing more to stand in support of ending systemic racism. One of the ways was leadership investing time to assess and then revise our DEI, community, and government relations strategies. This work results in elevating equity alongside diversity and inclusion.”

In addition, Westfield has created a new operating model by integrating DEI across all operations, provided time and space for sharing feelings and experiences, and hosted “Power of Each Learning Experience” to enable self-reflection opportunities and dialogues around DEI.

Moreover, Lamarre of QBE says that her organization focuses on “creating opportunities for underrepresented people to learn more about the insurance industry and gain higher education through scholarships and internships”. Efforts include expanding pulse surveys to measure employees’ sense of belonging and psychological safety, and continuing to place a lens through which DEI&B will be seen as a business imperative. Other steps are developing sponsorship programs and building up the analytics piece of DEI&B to have clear metrics to measure progress and enhance the overall diversity strategy.

“We had to set goals to achieve meaningful progress in gender and ethnicity representation at the most senior levels of the organization”

Gail Wien, AXIS Capital

A new direction

Despite their achievements, organizations that care about DEI are not resting on their laurels, and are eager to meet higher expectations from communities and colleagues, says Groza.

“Businesses are being held accountable for measurable action, not just good intentions,” she says. Based on their readings and learnings from their thought partners, experts and peers, Westfield anticipates a number of trends to be top of mind. These include a focus on psychological safety across multiple environment workplaces; incorporating equity across all aspects of the workplace; addressing environmental, social and governance issues; increased concentration on allyship and upstander behavior; and establishing DEI as a team priority.

Lamarre of QBE expects efforts to continue strengthening and representing all dimensions of diversity.

“Additionally, bringing ‘belonging’ further along; enabling employees to feel secure and authentic in sharing their feedback and ideas will need to be a huge focus. I anticipate the DEI&B journey will continue to progress and that the insurance industry will make greater strides in advancing these efforts,” she says.

Wien of AXIS Capital says DEI will continue to be critical to how companies do business and that stakeholders – such as employees and investors – will continue to demand transparency on progress in this area.

“Organizations who will be successful in this space will be those who have learned how to have open and honest conversations with their colleagues from underrepresented groups about the barriers and challenges they have experienced.”

Crucial work ahead

In the meantime, the winning companies are cognizant of the challenges involved in nurturing DEI within their workplaces.

Lamarre highlights the need to concentrate on strengthening QBE’s metrics. “There is truth to ‘what does not get measured does not get done,’ [so we’re ensuring] that we have better data and quantitative and/or qualitative measures in place for our DEI&B goals. [We’re also] bringing DEI&B to the forefront of our day-to-day activities and meetings so it is more rooted in our culture and not seen as an initiative or program.”

Groza emphasizes the importance of pursuing current plans and best practices as well as rolling out a full diversity recruitment strategy. She’s also intent on leveraging Westfield’s leaders to drive the DEI strategy and continue focusing on mentoring and sponsorship programs, not to mention supporting the continued evolution of measurement and transparency of dashboards.

For AXIS Capital, Wien says the challenge is incorporating a DEI mindset into recruitment, career development, performance management, succession planning, promotions, and organizational development activities, while ensuring that leaders at every level understand the value of pursuing this mission.

5-Star Diversity, Equity and Inclusion

- AXIS

- Tangram Insurance Services

- Topa Insurance Company

- Westfield

Methodology

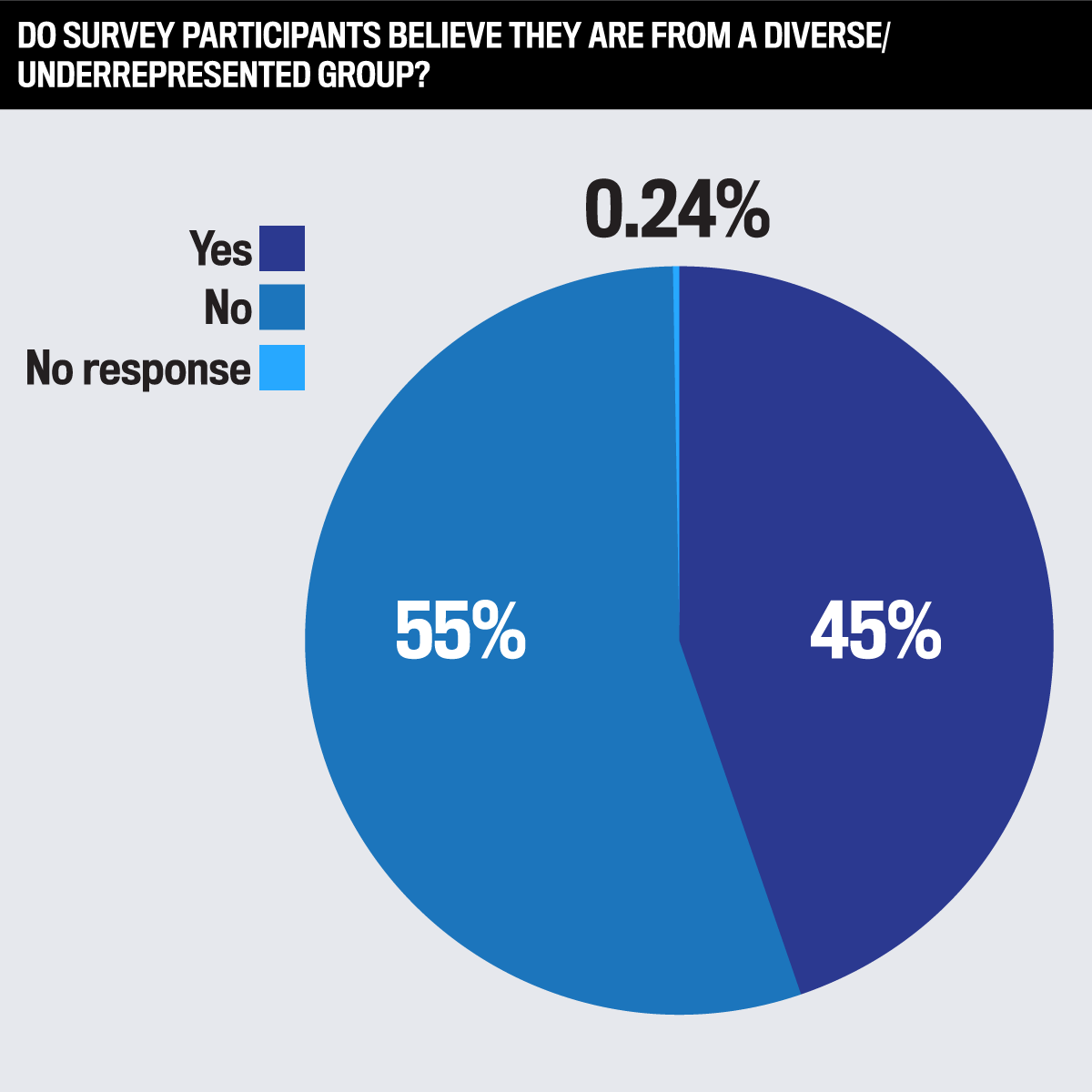

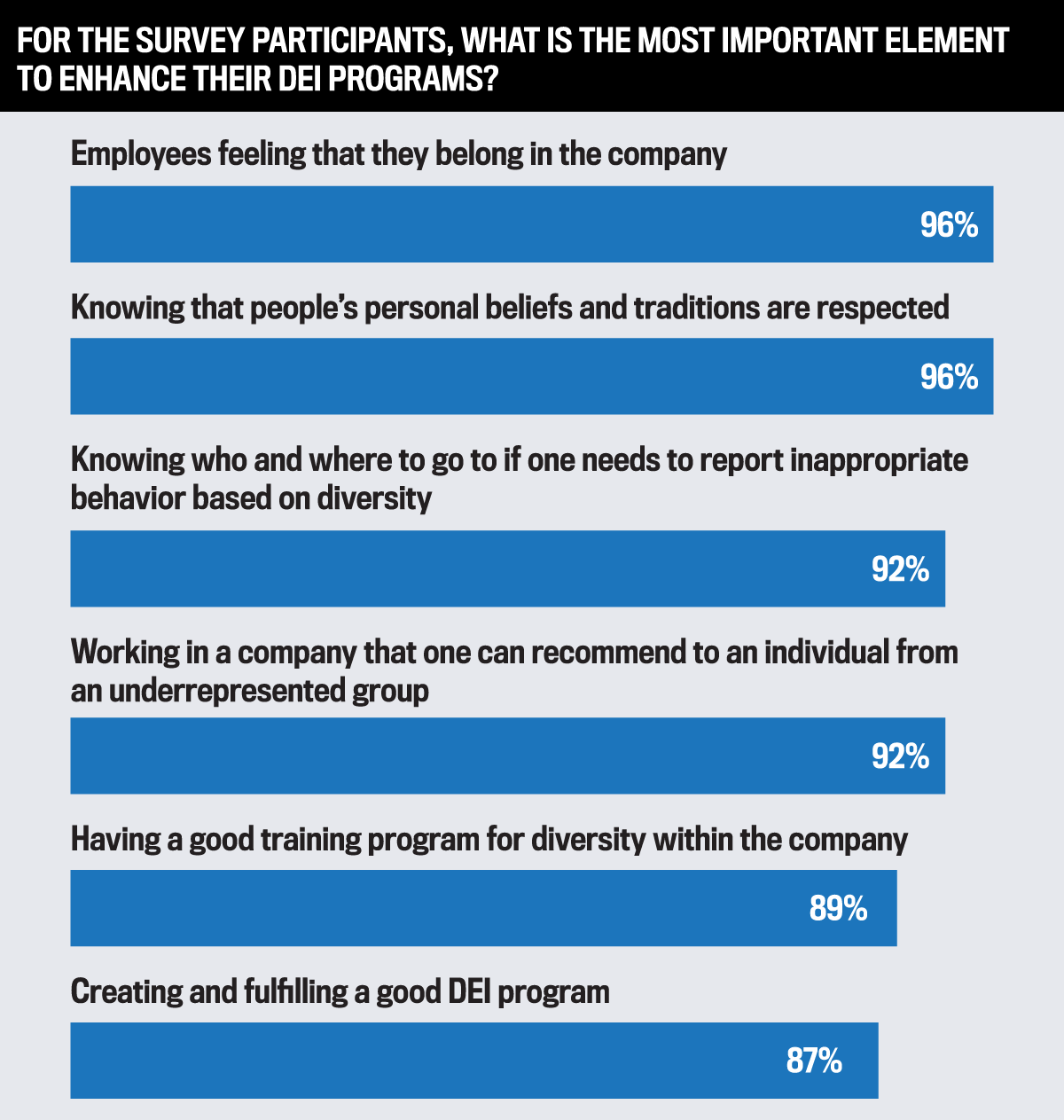

To determine the insurance companies with the most effective DEI programs, the Insurance Business America research team first invited firms to share the DEI initiatives they have focused on over the past 12 months. During a 15-week process, the team conducted one-on-one interviews with DEI professionals to gain a keen understanding of the industry standards for DEI and find out which companies have met or exceeded these expectations. After receiving nominations for DEI initiatives, the team reached out to the companies’ employees to gauge the effectiveness of these programs. The companies that scored 4.5 or higher on a scale of 1 to 5 were recognized for having 5-Star DEI programs.

4.96 is the highest score of a winning company

26% of respondents are in the 30-39 age range

18% have worked for 10+ years in their organizations

Keep up with the latest news and events

Join our mailing list, it’s free!