Fast Brokerages 2022

Jump to winners | Jump to methodology

Best practices and standout growth

At Insurance Business America, we like to see companies push the envelope and excel during unpredictable times. Over the past two years, the US insurance market has been pummeled by catastrophic weather, social inflation, and the many challenges and losses associated with the COVID-19 pandemic. At the same time, capacity issues and considerable rate increases perpetuated hard market conditions. In this context, the winners of IB America’s Fast Brokerages 2022 awards distinguished themselves by maintaining a more than 20% growth rate over the past two calendar years.

“We operate with a flat management structure and provide our people with the independence, resources, and relationships necessary to provide an unparalleled level of service to our clients”

Greg Zimmer, Alliant Insurance Services

Challenging times

Alliant Insurance Services, one of the Fast Brokerages, faced many hurdles presented by the pandemic. When COVID-19 hit, Alliant adapted quickly and seamlessly by moving its entire national employee base from office environments to remote work situations – all the while maintaining excellent customer service.

“Despite this rapid change, our employees stayed the course and continued to provide the same outstanding service and high level of responsiveness that make Alliant the best in the business,” says Greg Zimmer, president of Alliant. “Our clients and partners have relied on use more than ever to be communicative and resourceful, and our response has enabled us to emerge stronger and become more dynamic.”

Fellow award winner IMA Financial Group faced similar struggles with the pandemic. According to chairman and CEO Robert Cohen, the past two years were the toughest the company has seen in years. From March 2020 to April 2022, IMA employees worked from home, while their leadership team and associates stepped up their game.

“We overcame countless challenges by being thoughtful, sticking to our plan, making fiscally sound choices, focusing on the health and safety of our associates and keeping everyone employed,” Cohen says.

To find ways to connect, Cohen and the leadership team hosted everything from company-wide video addresses and webinars on inclusion to Zoom happy hours and myriad other events, which supported communication and belonging. “I led many of these efforts in the beginning because I knew the importance of a steady hand at a time of great confusion,” he adds.

Meanwhile, Ebens Jean and his wife, Gertha Jean, proprietors of One Way Insurance Group – the first Haitian-owned multilingual insurance agency in Delaware – faced struggles of a different kind. The Jeans sought mentorship to help foster growth but found it elusive; still, their company achieved Fast Brokerage status.

“Everyone seemed to be so secretive and was not willing to share any advice with us,” says Ebens Jean. “So, we decided to branch out of our surroundings. I went to an insurance conference in Virginia and connected with so many professionals in the insurance industry who have been able to help me with my brokerages and even mentor us.”

“Most companies focus on either organic or inorganic growth, but we have excelled in both, thanks to our core values”

Robert Cohen, IMA Financial Group

Driving revenue growth

The Jeans started One Way from scratch and, over the past two years, have seen a 233% revenue growth. How did they do it? The old-fashioned way: Ebens knocked on doors, hung up flyers, spoke at different venues. He walked through any door that was open to him.

“In 2020, the pandemic hit and everything stopped,” he says. “But all the work I had done before then was paying off. People started calling our brokerage because they saw a flyer I left somewhere and so on. Since opening our agency, we have never purchased a single lead.”

What’s more, the Jeans took advantage of the latest best practices in social media to further drive growth. They hired a media group that helps produce social media content such as posts of free information on insurance. “We started using TikTok to create funny videos related to insurance and crazy dance moves, and everyone loved it,” says Ebens. “Social media has become one of the fastest ways we have increased our revenue.”

Meanwhile, Alliant and IMA reported impressive revenue growth rates both in organic and non-organic ways.

“Organic growth stands at the forefront of our efforts,” says Zimmer. “We consistently strive to offer the highest level of service and use our deep resources, innovation, and expertise to build long-term relationships with our clients. We are also in the midst of a proactive acquisition campaign focused on bringing like-minded companies under the Alliant banner.”

In 2021, IMA acquired 15 companies, and five new companies have joined them this year. Cohen says: “Most companies focus on either organic or inorganic growth, but we have excelled in both thanks to our core values. But we are first and foremost an organic growth company. And we are out to prove the hypothesis wrong that as you get bigger, that organic growth number has to come down.”

The organic growth drive, independence, employee ownership and entrepreneurial cultures, says Cohen, attracts highly talented partners and associates. That, in turn, draws clients. “Our associates are subject-matter experts with the resources and experience to find solutions to the complex risk environment faced by today’s top businesses,” says Cohen. “And it’s not just one expert. We bring teams of experts that go beyond writing insurance and instead consult on all aspects of risk management.”

For its part, IMA Financial Group has had an 18% organic growth rate and a 22% growth rate in sales velocity.

“Social media has become one of the fastest ways we have increased our revenue”

Ebens Jean, One Way Insurance Group

Competitive differentiators

The ability to tackle challenges and seize market opportunities helps explain why Alliant, IMA, and One Way were able to garner high revenue growth rates. But were there other factors that facilitated their success? What else differentiated them in the marketplace and motivated clients to choose them over alternatives?

For many, insurance can be complicated and boring. The Jeans and One Way go out of their way to try to make insurance fun while also engaging the public. “We are able to educate our communities about insurance whether it be through a phone call, social media or speaking at events in English, Haitian-Creole and Spanish,” says Ebens. “In the midst of the pandemic, we started hosting free community events, such as holiday toy giveaways, free back-to-school giveaways, and free home-buying seminars to help our communities.”

Meanwhile, Zimmer says Alliant’s success is built on entrepreneurialism, service, and innovation. “We operate with a flat management structure and provide our people with the independence, resources, and relationships necessary to provide an unparalleled level of service to our clients,” he says. “This has enabled us to build a dynamic culture of collaboration and innovation while giving us the flexibility to adapt to changing market dynamics.”

IMA, on the other hand, has a strategic plan called IMA Next. First of the four-point initiative is maintaining a client-first mentality. Second is balancing organic and non-organic growth while remaining independent and employee owned. Third is a concentration on promoting a culture that protects assets and makes a difference. And finally, a focus on the future.

Cohen says: “We advance technology that achieves a seamless experience for both clients and associates and support a team of top talent with the resources and experience to find solutions to the complex risk environment of today – and tomorrow.”

Fast Brokerages 2022

1,000+ brokers

- Acrisure

101–500 brokers

- CAC Specialty

- Higginbotham

- IMA Financial Group

- We Insure Group

51–100 brokers

- ALKEME

- Reliance Partners

11–50 brokers

- Capstone Group

- Virtus

1–10 brokers

- Benadvize

- Desert Insurance Solutions

- GS Insurance Solutions

- IBS

- Matthew Cianci and Sons Insurance Counseling

- Navion Insurance Associates

- One Way Insurance Group

- The Selzer Company

Fast Starters

- ALKEME

- Benadvize

- CAC Specialty

- Matthew Cianci and Sons Insurance Counseling

- One Way Insurance Group

Methodology

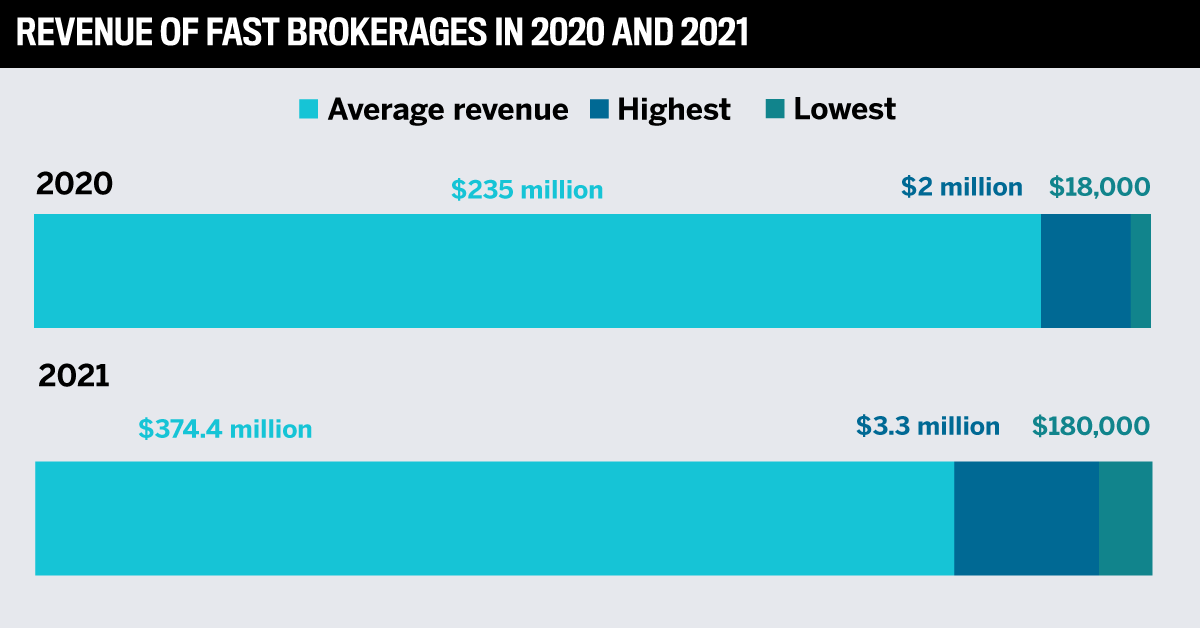

Insurance Business America invited submissions for its Fast Brokerages awards in January 2022 as the publication sought to recognize brokerages across the country that did not just weather the COVID-19 storm but actively thrived. The research team asked brokerages to list their revenue totals for the 2020 and 2021 calendar years, in addition to other growth milestones they wanted to highlight. They then evaluated the nominations received to determine which brokerages experienced standout growth.

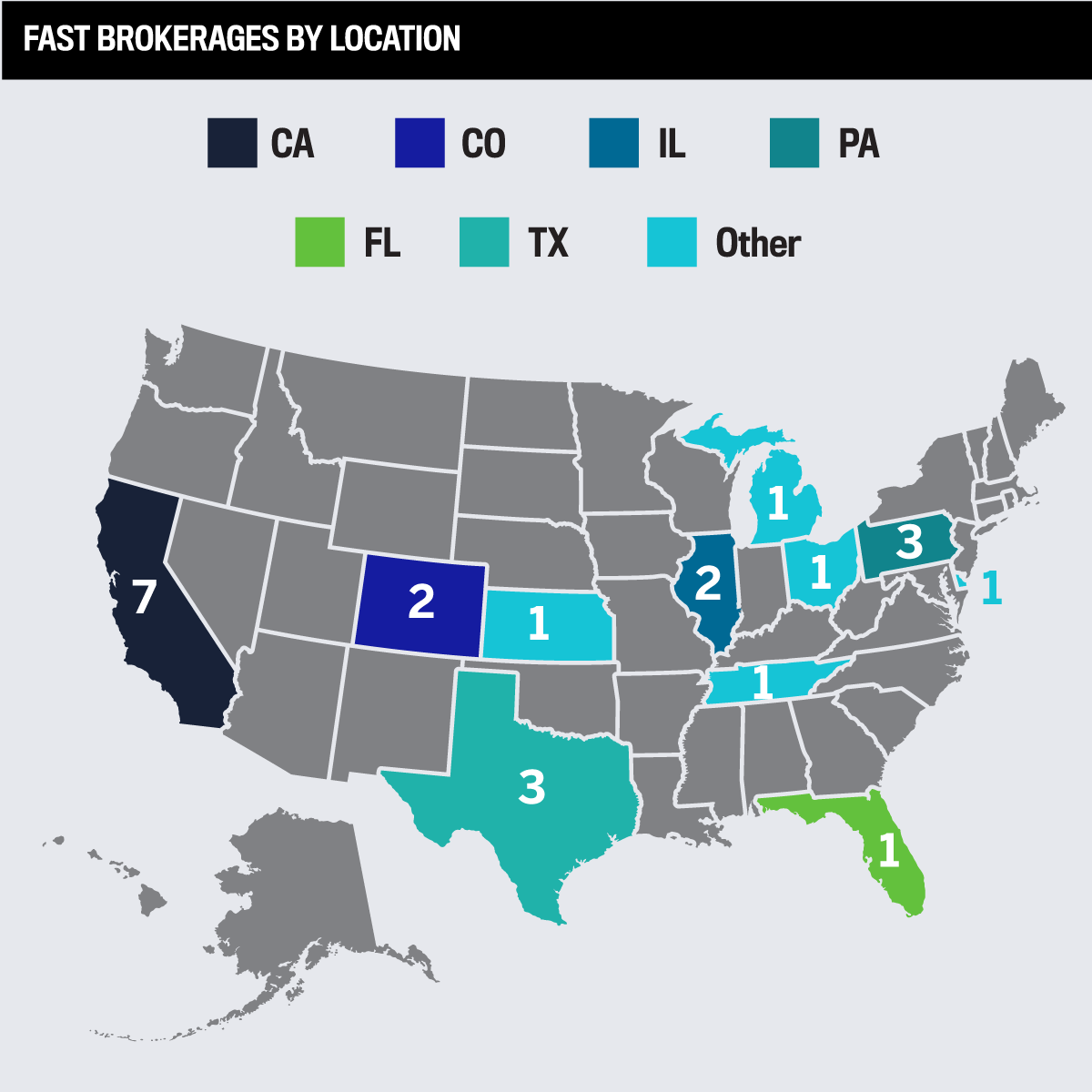

The 2022 Fast Brokerages awards are given to brokerages that achieved more than 20% growth in revenue volume. A total of 23 brokerages made the final list this year. IB America also highlights six brokerages as Fast Starters that have been in business for three years or less, making their mark on the insurance landscape. These brokerages confirmed their resilience and cemented their strong positions in the US insurance industry.

10 of the Fast Brokerages have been in business for 10+ years

324 was the average number of brokers in 2020

390 was the average number of brokers in 2021

Keep up with the latest news and events

Join our mailing list, it’s free!