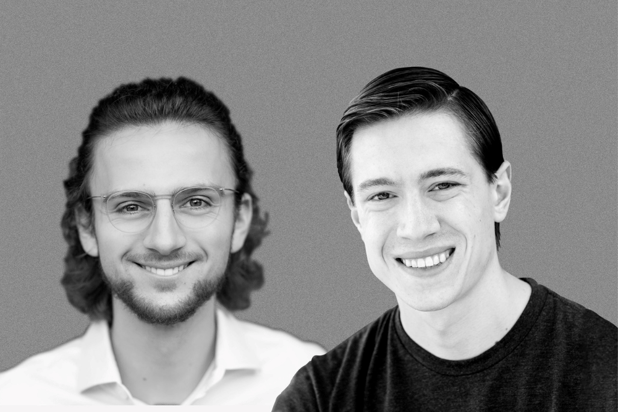

Entrepreneur. Problem solver. Innovator. Physicist. Business owner. Stanford grad. These are just some of the terms that can be used to describe Justin Lewis-Weber (pictured, left). But today, perhaps the most fitting title for the young businessman is ‘insurance claims automation champion’.

As CEO and co-founder of Assured, Lewis-Weber is using his tech-savvy brain to transform the insurance claims process by reimagining first notice of loss (FNOL) alongside fellow Stanford grad, Theo Patt (pictured, right). Assured’s white-label digital FNOL point solution uses artificial intelligence (AI) to address common pain points in FNOL – namely, unstructured data, inaccuracies, inefficiency, and poor customer service.

“Claims automation is really the Holy Grail of insurance,” said Lewis-Weber. “Fundamentally, it works on the three most important metrics that insurance companies care about: retention, expenses, and loss ratio. If we can solve the common pain points in claims through automation, then we can improve all three metrics dramatically.”

Lewis-Weber has experience in building out companies but Assured is the entrepreneur’s first foray into insurance. Before this, he drew on his Bachelor of Science in Aeronautics and Astronautics from Stanford University to create two companies focused on autonomous aircraft and wireless energy beaming spaces, respectively.

“The natural question is: why insurance? I wanted to work on something in software […] that I viewed as important and integral to the core functioning of society,” he told Insurance Business. “Obviously, fintech is working on core financial services that are very important – and I believe insurance is the most important of the lot.

“There are very few privatized products that are required by US law for consumers to own – car insurance is one of them if you have a car. I think that’s quite profound. I viewed insurance as this place that had been traditionally overlooked by really great software, and if we can bring great software to the space, then we could make improvements by leaps and bounds.”

To wet his feet in the insurance claims space, Lewis-Weber spent a lot of time in the early days of Assured at claim centers across the country, observing common practices and listening to adjudication calls and FNOL intake. He quickly came to realize that incumbent insurers are attacking the FNOL “problem” the wrong way.

“The problem lies in the underlying data,” he said. “Right now, FNOL is inexact and unstructured. It’s generally done by phone agents in long phone calls spread over several days, with the adjuster asking really open-ended questions like: ‘What happened?’ A normal person doesn’t know exactly what the adjuster is looking for, so they offer a narrative-style speech to cover all their bases. That then results in FNOL specialists trying to paraphrase what the claimants said into empty text fields called claim notes, which are almost impossible to adjudicate accurately.

“What’s needed, therefore, are structured, standardized and machine-readable data sets. How do you get there? We believe the only way to solve this problem is to ingest claims data from the onset in a structured and regimented way. Having deep, accurate and standardized data enables adjusters to compare apples to apples, which reveals meaningful differences and helps adjusters to provide the best possible customer experience at a really pivotal point in the claim cycle.”

Assured’s digital FNOL point solution acts as a single touch point for the user via a seamless and slick web application. The web app interfaces directly with the consumer and then writes the data gathered directly via the carriers’ existing core platform records. Lewis-Weber describes the data input as “intuitive” and “what you would expect” in 2021, using tools like GPS location, image compression upload and optical character recognition to reduce the amount of workload on the user. The solution also uses data enrichment and augmented data, such as historical weather satellite data or roadway geometry, to influence FNOL decisions mid-flow.

“The experience has a dynamic flow. There are a lot of different ways to crash a car, meaning that there are a lot of different pieces of information you have to gather depending on what happened,” said Lewis-Weber. “This often results in a really complex flow beneath the water line. Every single question we ask depends on previous answers, which means our questions are always relevant and the app is improving every day. We’re currently at over 8.55 million permutations of the flow, which is huge - and it’s all of that complexity that gives rise to a really intuitive user experience.

“We’ve ended up improving FNOL conversion significantly. We’ve been able to do that through our obsessive dedication to the user experience. There are no process edits, no confusing messages, really beautiful interfaces, and, most importantly, the process is easy and low touch for claimants.”