Insurance plays a crucial role in keeping our assets and loved ones protected. The irony here is that people often purchase this financial product with the hope of never actually using it. But accidents and disasters strike without warning – and when they do, those insured can be thankful for taking out the proper coverage.

When something bad happens, policyholders need to file an insurance claim to access their policies’ benefits. This often entails a complicated process but armed with the right knowledge, insured groups and individuals can find the path towards receiving payouts to be smooth sailing.

In this part of our client education series, Insurance Business will discuss the insurance claims process, how it works for different types of policies, and what impact it has on insurance premiums. We encourage insurance brokers and agents to share this article with their clients to help them navigate the often-complex procedures of filing a claim.

An insurance claim is a formal request filed by the policyholder to their insurer for compensation for covered losses or damages. These can include vehicular accidents for auto insurance, storm damage for homeowners’ policies, and emergency surgeries for health insurance plans.

Policyholders can only claim for losses or events specified in their policy documents, so it is crucial for them to carefully read through what’s written to understand what they are covered for. An experienced insurance professional can also help them sift through the jargon.

The insurance claims process often begins with the filing of the claim. This also serves to notify a company that an unforeseen incident has occurred. This step involves filling up paperwork, which includes evidence of the covered loss, and submitting it to the insurance company.

The insurer will then investigate the validity of the claim. If the claim is found to be legitimate, the insurance carrier will issue the payment to the policyholder or an authorized party. Depending on the type of policy, the insured may be required to pay the corresponding deductible before coverage kicks in.

How insurance claims are filed often varies depending on the type of policy. Here is how the claims-filing process goes for different forms of coverage.

The Insurance Information Institute (Triple-I), an industry body committed to helping the public understand insurance, shared these six practical steps to facilitate the filing of a car insurance claim.

Having the phone number of your insurance broker handy at all times is advised. While a general phone number for the office is good, having the exact phone number and extension of your agent is even more beneficial. Be sure to contact the agent or broker who sent you this right now for their phone number.

The claims-filing process for homeowners’ insurance is relatively similar to that of auto insurance, although there are slight variations because of the differences between the type of damages a house and a vehicle can sustain. For policyholders who have their properties ravaged by a covered event, Triple-I recommends following these steps:

Read more: Revealed – The most and least expensive US states for home insurance

Most health insurance plan holders may not need to file a claim themselves as this is often done by the medical services providers on their behalf.

For health insurance plans that require policyholders to submit their own claims, they may have to pay the healthcare provider upfront and send the receipts, as well as other relevant documentation, to their insurers. Claims forms can be typically accessed through the health insurance provider’s website or, if the policy is employer-sponsored, from the company’s human resources department.

Before accessing medical care, health insurance policyholders are advised to make sure that they understand what their plans cover, who is responsible for filing claims, and what documentation is required. Doing so can prevent them from incurring unexpected medical expenses and help facilitate reimbursement.

Need help with this? Read our guide on finding the best affordable health insurance plans. The advice is to the US, but there could be a few things in there that you could apply to your home country.

Filing a life insurance claim varies slightly from other types of insurance because the responsibility typically lies on the beneficiary rather than the policyholder. Add this to the grief of losing a loved one, which can make the process emotionally taxing. To make the process easier, experts advise beneficiaries to follow these steps:

Want to know something interesting? You can use life insurance to build wealth. It's not just about death and payouts of lump sums, there's more that it can do.

Just like when submitting a claim, the payment process also depends on the type of insurance policy.

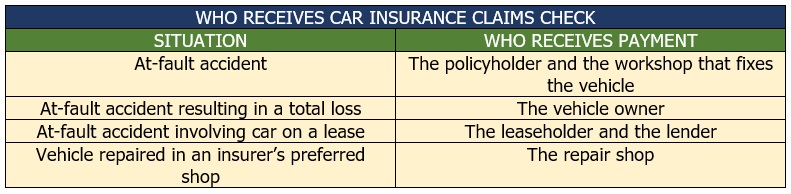

For car insurance claims, who receives the check often depends on the type of claim and who caused the accident. If the policyholder is at-fault in a car crash and files a liability claim, the other driver will receive the payment. For collision claims, the insurer pays out the cost to repair the policyholder’s vehicle. The table below details how auto insurance claims are often paid out.

After the adjuster has completed their assessment of the damages, the insurance company will then settle the amount depending on the type of coverage. Home insurance coverage comes in two main types:

If the property is under a mortgage, the home insurer will most likely send a check to both the homeowner and the lender. Most mortgage agreements follow this arrangement to protect the lender’s interests.

The insurance company typically releases a portion of the payout before construction or repair commences to allow the policyholder to hire a contractor. The insurer then releases more money as the building progresses and makes the full payment once the home is rebuilt and passes inspection.

For health insurance claims, the insurers often check first if the service is covered under the plan. They will also verify other important details of the policy, including copays, deductibles, and out-of-pocket maximums the policyholder may have paid throughout the policy term.

If the service is covered, the payment is sent to the doctor or the medical service provider. Depending on the policy, the insurer may reimburse a portion or the full cost of a service.

In health insurance plans that require the policyholders to submit the claims themselves, the plan holders may have to pay for the service upfront and wait for a reimbursement from the insurance company.

Life insurance plans work by providing a tax-free lump-sum payment to the policyholder’s family after they die. With the right policy, this type of cover can assist families in paying off loans and debts, as well as provide them with the monetary means to meet daily living expenses.

Coverage is available in several variations but generally falls into two categories:

Life insurance policyholders are required to designate a person who will receive the death benefit, also referred to as the beneficiary. This can be the insured’s spouse, immediate family, other relatives, friends, business partners, or even a charitable organization. Policyholders are also allowed to name several beneficiaries for their life insurance plans and assign how much benefit each person or group will receive.

An insurance claim may impact premium prices directly or indirectly, depending on the type of insurance, the insurance provider, and the details of a claim.

The policyholder’s claims history, for example, is among the major factors influencing home and auto insurance rates. At-fault collision claims may indicate that a driver is high-risk, while multiple weather-related home insurance claims may reveal that a house is in a disaster-prone area. Both instances can cause insurance premiums to rise.

Health insurance rates, however, work very differently. The Affordable Care Act (ACA) bars insurance companies from increasing a person’s premiums based on their health. Any changes in insurance prices must be based on the overall risk pool the policyholder belongs to. Many countries have similar laws.

To get an estimate of how much premiums will change for the coming year, health insurers evaluate how much medical care costs for each risk pool for the current year. Health insurance premiums may rise or fall depending on those calculations. If an insurer predicts that health care expenses will jump for men aged 40 to 45, for instance, a 42-year-old male policyholder can see his insurance rates spike, regardless of whether he filed one or multiple health claims.

Sage advice that financial experts give consumers is to be smart about what they claim. If the cost of damage a vehicle or property sustains is less or just slightly over the deductible amount, it may not make sense to file a claim. Deductibles are there exactly to prevent insurance companies from receiving a barrage of small and low-value claims.

Another advice consumer advocates give insurance policyholders is to talk to their agents about the insurer’s policies long before they need to file a claim. Some agents are obligated to report discussions about a potential claim to the insurance carrier even if policyholders choose not to file as this can reflect the chance of a risk occurring, which can affect premiums. Talk to your insurance provider right now about these very things to get the best possible advice on your situation and policy.

What about you? Do you have experience filing an insurance claim that you want to share? Use the comment box below.