Mistakes are an inevitable part of any business. These lapses, however, can result in huge financial losses and reputational damage, particularly if a client decides to sue. This is where professional indemnity insurance comes into play. Although not always legally required, this type of coverage is crucial for many businesses, especially for those that provide expert or advisory services.

This article discusses how professional indemnity insurance works in different occupations and why in most industries it is considered an essential form of financial protection. We encourage insurance agents and brokers to share this guide with their clients to help them find the coverage that best fits their businesses' needs.

Professional indemnity (PI) coverage is a type of business insurance policy that protects companies against claims of financial losses resulting from alleged or actual negligence during the fulfilment of a professional service. Depending on the industry, this form of protection can be referred to by different names – for example, errors and omissions (E&O) insurance in real estate, professional liability insurance (PLI) in construction, or malpractice insurance in the medical and legal fields.

According to the Insurance Information Institute (Triple-I), professional indemnity insurance policies come in two types:

Regardless of the industry, each professional needs to perform their jobs without the fear of unintended consequences. This is the purpose of professional indemnity insurance. This type of coverage allows professionals to act in the best interests of their clients and businesses knowing they are protected in the event they make a mistake.

PI insurance varies from other forms of liability coverage – general liability insurance and product liability insurance.

General liability insurance, sometimes referred to as business liability or public liability coverage, protects companies against claims of bodily injury or property damage resulting from their business activities. Businesses also do not receive compensation for this type of coverage. Instead, the payouts are given to the affected third party. Without this type of protection, companies will need to pay for the claims out of pocket.

Product liability coverage protects businesses against lawsuits from customers claiming losses or injury because of their products. Designed for companies that sell products, this form of insurance policy also covers legal defence costs and compensation if the business is found to be at fault.

A professional indemnity insurance policy covers legal and settlement costs arising from service-related mistakes. These include:

This happens when a professional fails to perform their duties and obligations to a required standard. Some instances where professional negligence occurs include an accountant giving poor financial advice, causing a client to miss out on huge tax benefits and a medical professional administering the wrong medication, resulting in severe complications, or the death of, a patient.

This occurs when a professional breaks the agreed-upon terms and conditions of a binding contract. This includes failure to deliver a specific service stated in the contract, resulting in huge financial losses for a client.

This happens when a professional makes a false statement that causes a customer to agree to a contract. This can include real estate agents padding the square footage of a property to raise the property’s value or an insurance professional inflating service costs or charging for services that were not rendered. If misrepresentation is discovered, the affected party can void the contract and seek damages.

This occurs when a professional violates the rules or standards set by their profession’s legal body. This includes:

Professional liability policies do not cover:

The first two are covered by general liability insurance, the third is covered by employment practices liability coverage.

Any individual or business that offers professional services or advice to clients should take out professional liability coverage – and for good reason. Allegations of negligence, inaccurate advice, and misrepresentation can result in exorbitant costs that can easily drain a company’s financial resources, whether they are proven liable or not. Professional indemnity coverage can protect them financially from the huge expenses arising from lawsuits.

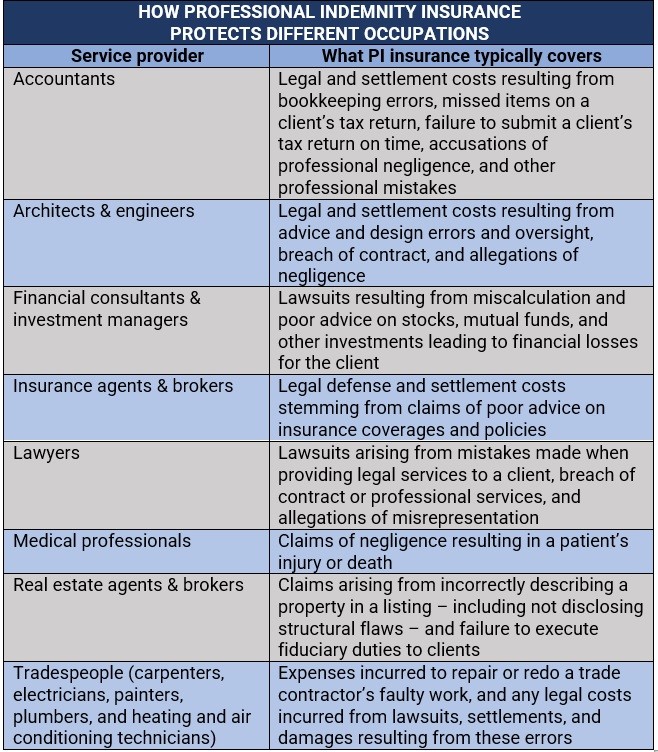

The table below sums up how professional indemnity insurance protects certain occupations.

Businesses in certain industries are required, either by law or industry standards, to take out professional liability insurance. Some clients may also require a professional or a company to have this type of coverage in place before agreeing to do business. These are some of the professions where coverage is necessary in the US:

Medical professionals are required by law to carry medical malpractice insurance. These include:

This type of professional indemnity insurance protects practitioners in the medical field against claims of negligence resulting in a patient’s injury or death.

Currently, legal malpractice insurance is mandatory only in two states – Idaho and Oregon. Nearly half of all US states, however, have implemented some form of disclosure rules requiring lawyers to notify clients whether or not they carry coverage.

Taking out errors and omissions insurance is compulsory for real estate agents and brokers in several states. These include:

Requirements, however, vary between states. In Colorado and Nebraska, for instance, real estate agents are required to get a policy with a minimum annual aggregate limit of $300,000. In Iowa and Mississippi, meanwhile, the minimum limit is $100,000.

Several states also require insurance agents and brokers to carry errors and omissions coverage. Similar to those for real estate professionals, each state has a different set of requirements. In Rhode Island, industry professionals need to have coverage with a minimum aggregate policy limit of $500,000. In Tennessee, the minimum limit is $100,000.

Under the Federal Acquisition Regulation (FAR), businesses working on government projects are required to carry professional liability insurance to protect them from “the perils to which the contractor is exposed.” These businesses include:

Whether professional indemnity insurance is mandatory for a certain occupation also depends on the region. Professionals in Canada and the UK are not required by the law to take out insurance, although several industry bodies make coverage compulsory for individuals and businesses to operate. In Australia, PI insurance is required for occupations considered high-risk, including:

Not all occupations are legally required to take out professional indemnity insurance. But even if coverage is not always compulsory, industry experts advise most individuals and companies to purchase this type of financial protection, especially if they are in the business of providing expert or advisory services.

Here are some occupations where professional indemnity insurance is considered essential.

As mentioned in the previous sections, not all occupations are required by the law to secure professional liability insurance. However, some industry associations make it compulsory for professionals in their field to take out coverage for them to practice or operate their businesses.

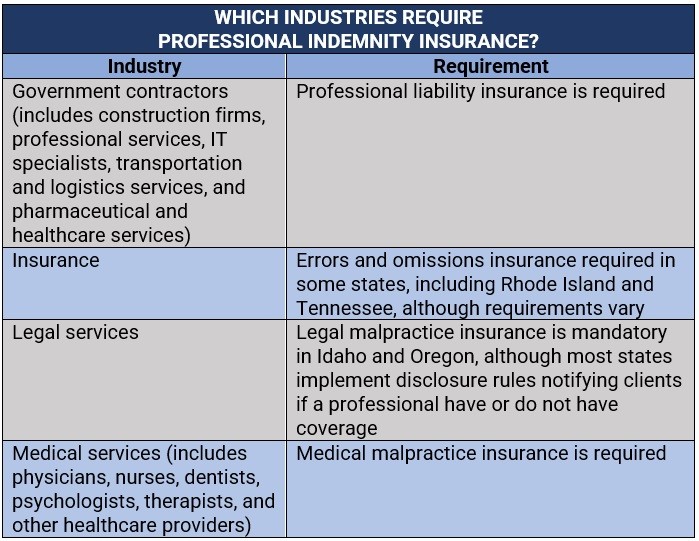

Here’s a summary of the industries where professional indemnity insurance is mandatory in the US.

What experiences do you have with professional indemnity insurance? Let us know in the comments section below.

What experiences do you have with professional indemnity insurance? Let us know in the comments section below.