Insurance brokers play a crucial role in helping their clients find the coverage best suited for their needs – something that makes the profession truly rewarding.

In this part of our client education series, Insurance Business explains what an insurance broker does, what it takes to become one, and how important the role is in the insurance industry. We encourage insurance agents and brokers to share this article with their clients who may be keen in joining the profession.

The primary role of an insurance broker is that of a middle-person. They act as intermediaries between the buyers and the insurance companies, with the goal of assisting individuals and businesses in finding the policies that cater to their unique needs. These industry professionals can work independently or as part of an insurance brokerage firm.

As they are not bound to a single insurer, insurance brokers can offer customers more coverage options compared to agents who work directly for insurance carriers. This also gives them the freedom to place policies with different providers depending on the market conditions, allowing them to access the best possible protection for their clients.

Knowing that you played a key role in helping clients achieve financial protection is what makes being an insurance broker fulfilling, so it is not surprising that many are considering on taking this career path. But to be successful, one needs to have a thorough understanding of how the insurance industry works.

Here are the steps to follow for those who want to pursue a career as an insurance broker:

Just like in any profession, there are minimum requirements that a person must meet if they are planning to become an insurance broker. These may vary depending on the region, but in the US, aspiring brokers typically must:

While a college degree is not a requirement for obtaining an insurance broker license, it can help build a solid foundation for the career. Although not that common, there are colleges and universities that offer insurance and risk management courses.

Studies focused on financial services, economics, business administration, marketing, accounting, and business law can also provide useful insights into the insurance industry. Communications, psychology, and sociology courses can likewise contribute to establishing a successful insurance broker career.

Internships with insurance companies can provide valuable learning and experience for aspiring insurance brokers. These can give students the chance to observe first-hand how an insurance company operates. High-performing interns may also have job opportunities waiting for them within the firm.

In the US, each state has their own licensing requirements that insurance brokers must meet. These often involve specialized coursework and passing an examination, including the Series 6 or Series 7 test that the Financial Industry Regulation Authority (FIRA) offers. For those planning to work across different states, they may have to meet the requirements of each to obtain a license. The same goes if they want to sell products for different “lines of authority.” These insurance lines include:

Most states in the US require insurance brokers to secure a broker bond before they are allowed to sell policies, according to the national industry association Independent Insurance Agents & Brokers of America (IIABA). Broker bonds are a type of surety bond aimed at holding brokers accountable for their actions. It also helps protect the public from potential fraud.

Most states require continuing education courses for insurance brokers to maintain their licenses. They may also consider obtaining additional certification in a line they have developed expertise for to further their professional development and job prospects.

The National Alliance for Insurance Education and Research (NAIER) offers several voluntary certifications, including those for counseling, customer service, risk management, and financial planning. These, however, require experience, coursework, and exams. Follow their Twitter to see what they’re up to:

In case you missed it! The 2023 Course Schedule is now available!

— National Alliance Ed (@NatlAllianceEd) November 21, 2022

View now: https://t.co/liulUFsljf pic.twitter.com/zRuTvx9BUU

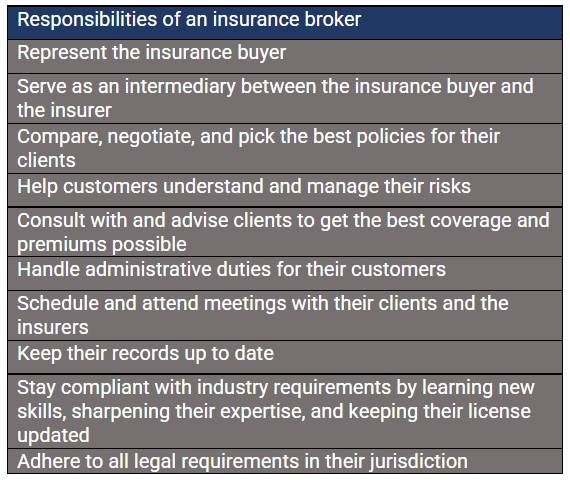

As a representative of the consumers, brokers are responsible for helping insurance buyers evaluate their risks and match them with the right policies based on their risk profiles and financial resources.

Some states in the US impose fiduciary duties on these professionals, meaning they are legally required to act only in the best interest of their clients. They are likewise expected to guide consumers through the entire insurance-buying process.

Customers may encounter three types of insurance brokers on their way to finding the right policies. These are:

Apart from insurance products, some insurance brokers provide risk management services. These include advising customers on how to control risks that may not be covered under their policies.

Despite acting primarily as a representative of the insurance buyers, brokers still owe insurers certain responsibilities. These include ensuring that the information they disclose to the underwriters during the application process is factual and truthful and that policyholders pay premiums on time. A number of insurance companies also give insurance brokers the power to quote, bind coverages, and handle claims on their behalf.

Here is a summary of the duties and responsibilities of an insurance broker.

Figures, vary, depending on the country.

While many insurance brokers, especially those working in brokerages, receive regular salaries, they also generate income in two ways:

Although often confused with each other, there is a huge distinction between an insurance agent and an insurance broker. Unlike brokers who are not obligated to sell policies for specific insurance companies, agents are contracted to distribute the products of their partner insurers.

There are two types of insurance agents:

Captive agents: Work exclusively with an insurance provider.

Independent agents: Represent several insurance companies.

Similar to independent brokers, insurance agents act as an intermediary between customers and the insurer. But because agents represent insurance companies, the coverage options they provide buyers are limited to those offered by their partner carriers. Typically, agents also have contracts with insurance providers, detailing what policies they are allowed to sell and the amount they can expect to make from selling these policies.

Another key difference is that because of their links to the insurers, agents have the power to bind coverage, something that most insurance brokers cannot do.

Are you planning on pursuing a career as an insurance broker? Did you find this article insightful? Share your thoughts in the comments section below.