Along the Hudson River, in the foothills of the Adirondack Mountains, live the most well-paid insurance agents in the country.

The men and women in Glens Falls, New York who earn their living consulting on and selling insurance policies bring home an average $127,240 a year – nearly double the salary of most of their colleagues across the country.

According to the latest data from the Bureau of Labor Statistics, the average salary of an insurance agent in the United States is $64,790. It’s the highest average salary ever associated with the role, which earned just $47,450 in 2013.

While agents – most of whom are paid largely on commission – have more control over their take-home earnings than most professions, there are still a number of aspects relating to pay that are largely untouchable. Else why would Glens Falls agents earn a massive 476% more than their peers in Southwest Mississippi, who bring home just $22,090 a year?

When it comes to calculating agent compensation, a whole host of factors go into that final figure, but geography, employer and experience are among the most defining.

Cities

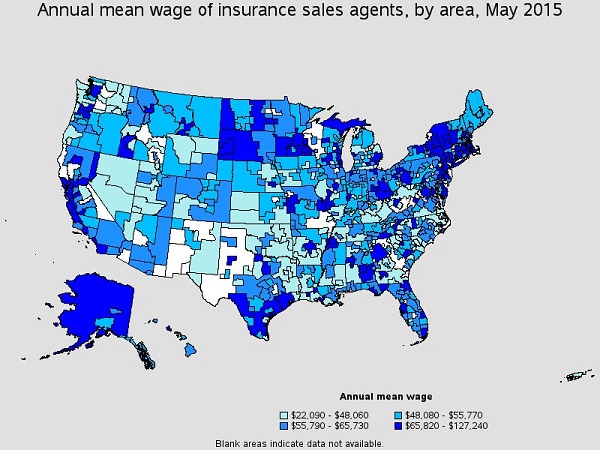

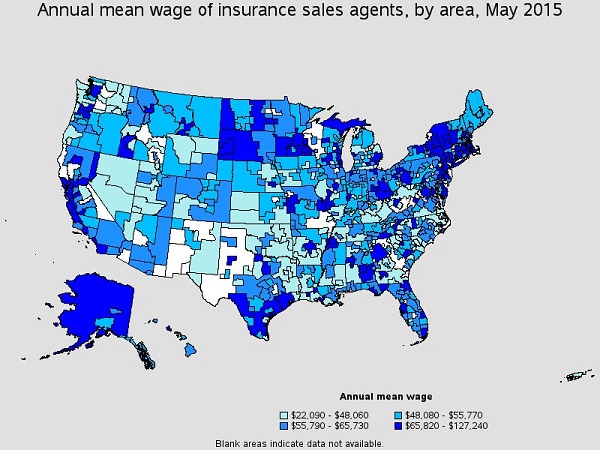

So where, along with Glens Falls, is really paying insurance agents for their work?

In general, it helps to live east of the Mississippi. Nine out of the top 10 best-paying metropolitan areas are in the Eastern portion of the US, including five in New York and New England. The entire list includes:

- Glens Falls, New York: $127,240

- Dutchess County-Putnam County, New York: $126,510

- Appleton, Wisconsin: $112,490

- Albany-Schenectady-Troy, New York: $109,110

- Lawrence-Methuen Town-Salem, Massachusetts: $106,970

- Leominster-Gardner, Massachusetts: $106,490

- Oakland-Hayward-Berkeley, California: $104,900

- Minneapolis-St. Paul-Bloomington, Minnesota, Wisconsin: $103,340

- Dayton, Ohio: $99,770

- Lake County-Kenosha County, Illinois, Wisconsin: $94,220

Nonmetropolitan areas aren’t quite as competitive, but agents in some regions earn just as much (or nearly as much) as their urban counterparts. They include:

- Central New York nonmetropolitan area: $100,040

- Southwest Minnesota nonmetropolitan area: $95,290

- Southeast Alabama nonmetropolitan area: $81,960

- Far West North Dakota nonmetropolitan area: $78,430

- Capital/Northern New York nonmetropolitan area: $76,920

Image Source: US Bureau of Labor Statistics

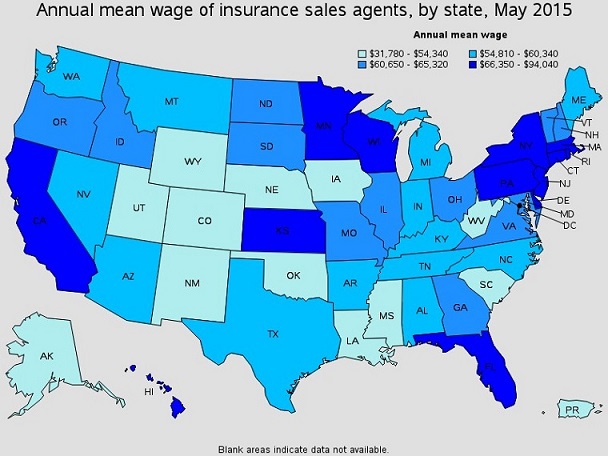

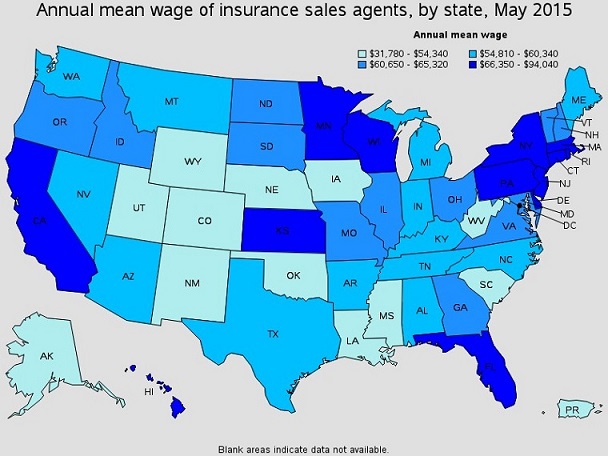

States

Image Source: US Bureau of Labor Statistics

States

Given the city data, the states in which insurance agents earn the most are expected. They include:

- Minnesota: $94,040

- New York: $82,540

- Massachusetts: $78,160

- Wisconsin: $76,500

- California: $74,420

The numbers have shifted slightly since earlier in the year. Rhode Island, once the top-paying state for insurance agents, is no longer on the top five list, while California increased from $71,510 to $74,420.

Image Source: US Bureau of Labor Statistics

Companies

Image Source: US Bureau of Labor Statistics

Companies

Of course, geography becomes nearly irrelevant when an agent is working for one of the top brokerages in the country. The biggest companies are, unsurprisingly, willing to pay higher salaries and more likely to put agents in the path of major clients who buy more insurance, higher policy limits and other services that increase commission.

According to data from Glassdoor.com, an employee/employer rating service,

Marsh & McLennan pays out the most in agent compensation at an average $93,287 a year. Brown & Brown takes a somewhat distant second at $69,491, while Willis agents earn roughly $68,743.

Aon agents take home $60,000 annually.

Experience

Experience has a moderate effect on insurance agent income, data from Payscale.com reveals. Entry-level insurance agents earn an average $48,000, expanding up to $71,000 at the 5- to 10-year mark. “Experienced” agents, those with 10 to 20 years of experience earn $85,000 while those who have been in the game for more than 20 years make an average $95,000.

This career progression is not difficult to understand. The longer an insurance agent spends in his or her career, the larger the book of business and reach of their influence.

In fact, the aging insurance industry (the average producer is now 59 years old) may have something to do with the meteoric rise in compensation for agents.

The BLS also noted that the best-paid agents often do business with outpatient care centers and securities and commodities firms. Job concentration may also be a factor—each of the top 10 best-paying states had an agent job concentration of between two and four producers per 1,000 jobs, suggesting that where producers have larger shares of total employment, average income increases.

Related stories:

Is the broker commission model fundamentally flawed

Are insurance agents being paid what they’re worth?