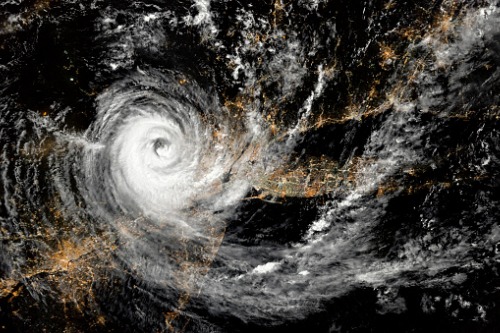

The impact of hurricane activity in the US can be visualized in a similar manner to throwing a rock in a pond. The rippling effects that hurricanes such as Ida have had on surrounding states, has left insurers desperately trying to figure out how to minimize losses in 2022.

Bill Gatewood, personal insurance practice leader and senior vice president at Burns and Wilcox, sat down with Insurance Business at WSIA in San Diego to discuss how hurricane activity over 2021 changed the property and casualty (P&C) segment.

“Hurricane Ida is the second category four storm in Louisiana within two years and has taken a huge toll on the market,” he said.

Over the prior months, insurers were fleeing the market, and, with not many companies sitting on the sidelines waiting to take on that capacity, Gatewood noted that tackling these issues would be no easy task as rates increase further moving into 2022.

“We’re also going to see increases in wind deductibles,” he said. “They were at the 2-3% level, but now they’re going up to 5% across the board.”

The rise in deductibles will help provide some stability to the market but more burden will be placed on homeowners. To avoid customers spending excessively on insurance and repairs, mitigating property risks is key.

Brokers must have a holistic risk management approach and, to do so, they must focus on building strong relationships with both clients and wholesalers.

“The best thing a retail agent and broker can do in a state like Louisiana, where there’s so much E&S business is having one or two wholesale partners,” Gatewood explained. “Everyone is looking to have deeper relationships with less people.”

Brokers and agents do not need to be in a position where they have multiple wholesale relationships - rather the way the industry will deal with capacity issues will be through meaningful, long-term partnerships.

“When you reserve the capacity for your biggest and best partners, that is where the time spent building those relationships will pay off,” he added.

After a bond is created with wholesalers, the next step for brokers and agents is building relationships with clients to best assess risk profiles.

In Louisiana, homeowners have been around the block and do a good job when it comes to post-hurricane repairs, but the major step for them to take is making sure their homes’ infrastructure is updated and well maintained.

Gatewood said that agents should be talking to clients about what updates should be done and informing them about wind deductibles as the increase will help offset budgets for improvements or repairs.

“We don’t have to start from ground zero but there’s a bit of education for clients in Louisiana because although they’ve experienced hurricanes before I don’t think they’ve seen this type of market since Katrina,” he said.

“The reinsurance market is also going to play a big role as deals come up in January,” he added. “We have to watch pricing as that will roll down to insurance carriers and other syndicates. The industry has an idea of where it wants to go, it is just not certain about how to get there - but that will become clearer in 2022.”

For brokers and agents, taking a proactive approach to educating clients on the nature of the insurance marketplace will provide them the information they need to make the best financial decisions. Climate change is not slowing down, and more frequent and severe hurricanes are anticipated by all - sitting around and waiting to see what happens is not the strategy to take.

“A lot of conversations have been about what has been done following Ida and what we are going to do moving forward,” said Gatewood. “This is not a temporary cycle. Action is required.”