The largest insurance companies in the world boast a combined $3.2 trillion in market capitalization, which indicates how much they are worth based on the stock market. Also called market cap, this metric is often used to determine a company’s size and compare its financial performance with other firms.

In this article, Insurance Business ranks the 20 world’s largest insurers based on market cap. These companies account for almost two-thirds, or about $1.93 trillion, of the global figure. If you’re an investor looking at the insurance industry as a way to diversify your portfolio, this list can help narrow down your options. Read on and find out the 20 largest insurance companies in the world by market cap!

Head office location: Minnesota, USA

Market cap: $459.05 billion

Business line: Health insurance

UnitedHealth Group is a diversified health and well-being company based in Minneapolis. The health insurance giant serves clients and consumers in the US and over 130 other countries through two distinct platforms, namely:

Not only are they the largest insurance company in the world based on market cap but UnitedHealth also boasts a workforce that includes 85,000 nurses and physicians focused on helping people live healthier lives. It also invests nearly $3.5 billion in technology and innovation, and processes approximately 1.1 trillion transactions annually.

Head office location: Shenzhen, China

Market cap: $132.54 billion

Business lines: Life and health, and property and casualty insurance

Ping An Insurance Group is one of the largest insurance companies in the world, catering to more than 220 million clients and nearly 611 million online users. It employs over 362,000 staff globally. The company’s insurance business consists of two lines. These are:

Ping An conducts its health and life insurance plans through Ping An Life, Ping An Annuity, and Ping An Health. They are among the first life insurance companies to use AI-powered robots to conduct sales agent recruitment interviews. They have also launched an exclusive smart personal assistant called AskBob. This tool provides agents with various sales-enabling prompts to help them improve sales conversions and be more productive. The tool is showing promise:

Ping An’s P&C unit covers the following businesses:

Ping An uses new technologies to promote online customer development and improve its service system:

Head office location: Hong Kong, SAR

Market cap: $122.43 billion

Business lines: Life and health insurance

AIA Group is the largest pan-Asian life insurance group. It offers financial services and insurance products in 18 markets across the Asia-Pacific region. These include:

For individuals, AIA’s selection of insurance products consists of:

AIA also provides employee benefits and pension services to corporate clients to cover employees’ health, income protection, and retirement needs. The company employs specialists in each country who are responsible for delivering services and benefits products to companies of all sizes.

Head office location: Beijing, China

Market cap: $121.70 billion

Business lines: Life and property and casualty insurance

China Life is one of the largest providers of individual and group life insurance, annuity, and accident and health policies in China. As one of the largest insurance companies in the world, they boast an extensive distribution and service network consisting of:

China Life has approximately 317 million long-term individual and group life insurance policies, annuity contracts, and long-term health insurance plans in force. It also provides individual and group accident and short-term health insurance policies and services.

Head office location: Indiana, USA

Market cap: $113.69 billion

Business line: Health insurance

Elevance Health provides the following plans to its more than 32 million members:

These plans are distributed through its affiliated companies Anthem Blue Cross and Blue Shield and Wellpoint.

Elevance Health is the largest for-profit managed healthcare company in the Blue Cross Blue Shield Association. It boasts a network of 1.7 million doctors and hospitals in 14 states, namely:

Elevance Health was formerly known as Anthem. The health insurance giant changed its name in June 2022.

6. Allianz

6. Allianz Head office location: Munich, Germany

Market cap: $93.51 billion

Business lines: Property and casualty, life and health insurance

Allianz Group offers property and casualty, life and health, credit, and business insurance, and asset management services via several brands and subsidiaries to more than 126 million customers in over 70 countries. It also employs more than 155,000 people worldwide.

Apart from Allianz, which is among the largest insurance companies in the world, among the group’s top brands are:

7. Cigna

7. Cigna Head office location: Connecticut, USA

Market cap: $87.33 billion

Business line: Health insurance

Cigna’s various insurance plans and products include dental insurance plans, Medicare plans, healthcare insurance for individuals and families, Medicare supplemental plans, other supplemental insurance, and even some international health insurance options. It has a 70,000-strong workforce serving over 190 million customers in more than 30 countries.

Cigna offers health and wellness products and services through its two units:

Head office location: Zürich, Switzerland

Market cap: $86.55 billion

Business lines: Property and casualty, health and life insurance

Chubb employs more than 31,000 people worldwide and has operations in over 50 countries and territories. The industry behemoth’s impressive portfolio of insurance products spans a variety of lines, from commercial P&C insurance products for businesses of all sizes to personal lines. The latter includes:

Chubb uses retail and wholesale brokers, independent and captive agents, as well as bancassurance (collaboration with banks), mobilassurance, direct marketing, and other channels to distribute its products. For brokerages using Chubb, they provide tools, resources, and programming – such as product training assistance – to help its growing number of partners be successful.

9. Progressive Insurance

9. Progressive Insurance Head office location: Ohio, USA

Market cap: $83.45 billion

Business lines: Property and casualty insurance

The Progressive Group is one America’s most popular insurance brands. The insurance giant is among the largest auto and motorcycle/specialty RV insurers in the country. Progressive writes over 13 million auto insurance policies each year.

Although best known for its auto insurance products, Progressive also offers a range of coverages for personal and commercial risks. Its portfolio includes:

Progressive sell their insurance policies directly to consumers or via a network of independent agents. Its agency business distributes products through more than 30,000 independent insurance agencies across the US.

Progressive is also credited as the first major auto insurer companies in the world to launch a website, no doubt being part of their push to become one of the biggest insurance companies in the world. In what was then a revolutionary move, the insurance company launched its site in 1995. By 1996, they even gave consumers the ability to compare insurance rates online. A year later, Progressive clients were able to buy auto insurance policies online in real time.

At present, the insurer has a thriving direct-to-consumer business, which is supported by a number of 24/7 digital tools. These include:

Head office location: New York, USA

Market cap: $81.07 billion

Business lines: Insurance broking and risk management

Marsh McLennan Companies (MMC) is a professional services firm that’s behind some of the largest insurance companies in the world, including:

MMC is also the parent company of major consulting players Oliver Wyman – a global management consulting firm – and Mercer – a human resources consulting company.

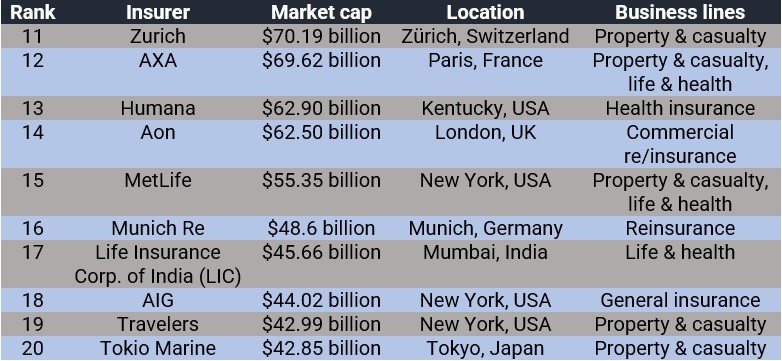

The table below shows the rest of the 20 largest insurance companies in the world by market cap.

The market cap data was pulled from this website. Also referred to as market cap, market capitalization is the total market value of a company’s outstanding shares owned by stockholders. In simple terms, it is how much the company is worth as determined by the stock market. Market cap is calculated by multiplying the number of outstanding shares by the current market value of a single share.

Investors typically use market capitalization to determine a company’s size rather than its sales or total assets. The figure is also used to evaluate a company’s financial performance against other firms of various sizes.

Determining a firm’s market cap is important, especially for the investing community, because companies with larger market capitalization are often seen as safer investments as they are also mostly established industry players with a longer history in the business.

Now that you know which firms rank among the largest insurance companies in the world, it’s time to find out the world’s leading reinsurance firms. Check out our latest global reinsurance companies ranking here to learn more about some of the largest insurance companies in the world using a different metric.

Do you have experience with the largest insurance companies in the world that you want to share? Chat us up in the comment box below.