Top Specialist Brokers

Jump to winners | Jump to methodology

Turning risks into rewards

By providing coverage for niche markets, specialty insurance brokers deliver a variety of targeted insurance products, such as coverages for security guards, cannabis, construction, elevator industry, flood, excess and surplus lines, and Medicare. To celebrate the Top Insurance Specialists for 2022, Insurance Business America spoke with the winners in environmental, flood, and personal article floater (PAF) insurance about their fields.

“Increasing self-esteem by becoming an expert or specialist at something, knowing how to assert yourself, and being able to offer value and help others is extremely motivating and rewarding”

Tanya Andolsen, Argosy Risk Specialists

Expansion of coverage

Over the past 25 years, Tanya Andolsen, president of Argosy Risk Specialists and one of this year’s winners, has seen the environmental insurance sector transform from covering mainly high-risk chemical and hazardous waste industries to insuring companies across all industries as part of their corporate insurance plans to fill coverage gaps in their casualty programs. Real estate owners and developers now use environmental insurance regularly to facilitate transactions. In 2020, there was a lull in activity due to the initial COVID-related lockdowns, but the situation began to improve in 2021, and there’s a positive outlook for 2022.

“While most environmental insurance premiums have remained flat, there have been and continue to be rate increases for environmental products that have a combined casualty or excess line of coverage,” Andolsen says. “More important to note is that experienced underwriters continue to make more calculated decisions when it comes to exposure analysis and pricing.”

Another winner, Diana Duke, a senior flood underwriter and commercial lines underwriter at the New England Excess Exchange, has observed many changes recently. “Private flood and the federal flood program have seen dramatic shifts in the last year, with more changes to come,” she says. “Multiple private flood markets edging into the flood pool, changes to the National Flood Insurance Program with Risk Rating 2.0 methodology, and a significant rise in flooding events, in areas not usually prone to flooding, have left many people looking at flood coverage more closely.”

In the near future, Duke sees private insurers gaining market share on government coverage options and fostering big changes in how coverage is provided.

Genette Nice, a special risks senior underwriter focusing on personal article floaters (PAF) for Monarch E&S Insurance Services – and another winner – says: “The market for personal lines as a whole has been difficult as well as PAF coverage. In past years, the carriers were concerned about brush exposure but not as focused as they are today. The market was not as concerned about brush for the jewelry schedules either but not the entire risk is reviewed for brush exposure as well as the maps have changed to include a larger area. I believe we will continue to see markets restructure their rates and areas they are open to writing in which will continue to move more risks into the surplus lines market.”

“I tend to mentally break things down to small pieces to see how they fit into the insurance world. Once the smaller parts of a problem are solved, we begin to see a solution to the larger need”

Diana Duke, New England Excess Exchange

Acquiring and maintaining skills

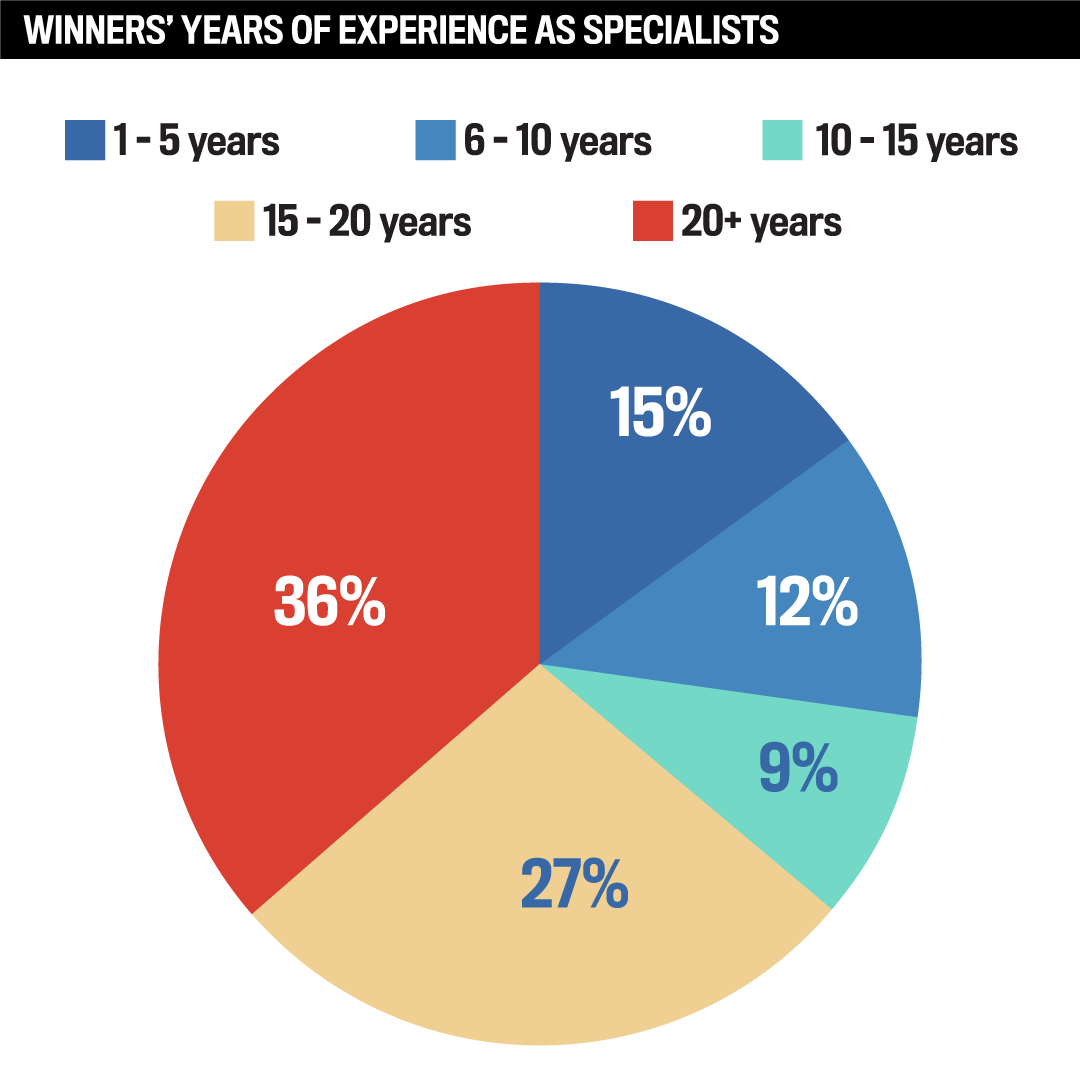

What does it take to be a Top Specialist Broker? Experience, primarily.

Previously a niche coverage, environmental insurance has evolved into more of a mainstream risk management concern, and Andolsen has had the opportunity to see different sides of the industry. Working on the carrier side, she learned to underwrite and analyze environmental risks. As a retail agent, she refined her sales skills and learned how to target business owners’ needs.

“Now, as a wholesale broker, I work with both the retail broker and the carriers,” she says. “I respect what both sides are trying to accomplish and am able to bridge the communication gap and offer expertise in addressing environmental risks.”

As for Duke, she has built up her knowledge base through seminars, webinars and conferences, as well as the independent study of flood insurance and underwriting flood coverage.

“In turn, I have been able to offer flood webinars and on-demand videos to our valued independent agents,” she says. “I also follow changes in the marketplace, and in government and lender regulations to help me stay ahead of trends and updates, allowing me to stay sharp when it comes to flood insurance.”

Meanwhile, unlike other underwriters who might spend all of their time and focus on personal lines, Nice says she and her team write a variety of coverages but focus primarily on PAF coverage.

“Growth does not happen by yourself, you need to have good support working with you that is trained and feels part of the team. Communication is key”

Genette Nice, Monarch E&S Insurance

Distinctive success formulas

For the survey to select the Top Specialist Brokers, Insurance Business America asked a series of significant questions: How are the nominees’ value proposition reflected in financial success? How did they respond to challenges? And how did they keep up with trends in their specialty areas?

Since Andolsen started Argosy, she has been successful in providing a value to partner retail brokers by delivering seamless environmental insurance expertise. She maintains an excellent reputation by being thoroughly open and honest with brokers and clients, as well as taking advantage of the resultant and subsequent referrals and opportunities.

“There have been many submissions that I’ve chosen to pass on quoting because after an exposure analysis and review of their current program, it’s apparent that they are in a good place, have a good relationship with the carrier, and coverage is competitively structured and priced,” she says.

Continually networking with peers and keeping up with emerging issues through everything from seminars to LinkedIn content enables Andolsen and Argosy to help educate brokers and clients on what insurance options are available to address potential environmental risks.

Meanwhile, Duke has increased her book of flood business by $2 million over five years and has recently gone out of her way to keep up with the burgeoning demand for flood insurance during the pandemic while leveraging her tenacity to achieve a 21% increase in flood premium for the 2021 fiscal year. Known as the “Workaround Queen,” Duke is always looking to solve basic and complex challenges, often turning problems into opportunities.

“I tend to mentally break things down to small pieces to see how they fit into the insurance world. Once the smaller parts of a problem are solved, we begin to see a solution to the larger need,” she says. To keep up with the market, Duke continuously monitors legislation, financial regulations, company changes and trends set forth by competitors.

For Nice, her relationship with retailers and carriers or syndicates at Lloyd’s is key to driving growth. She also keeps up with her sector through conversations with carriers and competition and reading trade articles. Regarding challenges, she says: “Due to our long-standing relationship with underwriters, we have some very good contracts in place that they trust us with full underwriting and binding authority, which gives us the opportunity to be creative with coverages to get things done.”

Words of encouragement

For those seeking to be recognized in their field, for example, as a Top Insurance Specialist, Andolsen recommends being proud of one’s excellent performance. “Increasing self-esteem by becoming an expert or specialist at something, knowing how to assert yourself, and being able to offer value and help others is extremely motivating and rewarding,” she says.

Duke encourages professionals to pursue their passions and interests to the fullest extent – and be ‘extra’ about it – regardless of the possibility of receiving an award. “My passion for flood insurance came from a personal experience in which my family was affected by a flooding event. What it has turned into is being passionate about how flood insurance impacts everyone, and how I can help agents and insureds find protection from unnecessary losses.”

Nice emphasizes the importance of maintaining relationships. “Continue to talk to your retailers, ask them what they are in need of most. Talk to the carriers and see what trends they are seeing. If a risk was bound elsewhere, don’t hesitate to ask the retailer what set the other policy apart from you so you can assist better next time. Growth does not happen by yourself – you need to have good support working with you that is trained and feels part of the team. Communication is key,” she says.

Top Specialist Brokers

- Cyndi Johnston

Vice president: producer/broker, USG Insurance Services - Diana Duke

Senior flood underwriter, New England Excess Exchange - Elizabeth Gunther Pullen

First vice president: producer/broker, USG Insurance Services - Eric Hicks

Vice president, Great Lakes General Agency - Fred Bautista

Executive vice president, RT Specialty - Gary Grindle

Executive vice president, AmWINS Group - Genette Nice

Senior underwriter, special risk department, Monarch E&S Insurance Services - Jeffrey Case

VP/Commercial lines broker, Hull & Company - Joe Bukovsky

Vice president, transportation practice leader, PMC Insurance Group - John Tateossian

Senior vice president, HUB - National Elevator Insurance Program, Division of Specialty Program Group - Matthew Romano

Vice president, flood, Monarch E&S Insurance Services - Michael Freishtat

Vice president, RT Specialty - Michael S Gill

Partner, Synapse Services - Nicholas Freeman

Associate managing director, casualty broker, Burns & Wilcox Brokerage - Nick Kohal

VP of Sales, Broker, American Risk Management Resources Network - Pamela Alphabet

Regional practice group leader, personal insurance, Burns & Wilcox - Paul Gaglioti III

CEO, Harbor.ai LLC - Peter Taffae

Managing director, Executive Perils - Raffi Kodikian

Senior VP, LPL practice leader, Founders Professional - Violetta Sabok

Senior personal lines, Monarch E&S Insurance Services, Southeast Region

Methodology

Insurance Business America invited insurance professionals from across the country to nominate exceptional specialist wholesale brokers for the sixth annual Top Specialist Brokers list. Nominees should possess unique insights and highly developed skill sets tailored to their particular specialty, which they use to help retail agents and their clients secure the best coverage possible.

Nominators were asked to describe their nominee’s standout professional achievements over the past 12 months, along with their contributions to the financial success of clients and business partners in 2021.

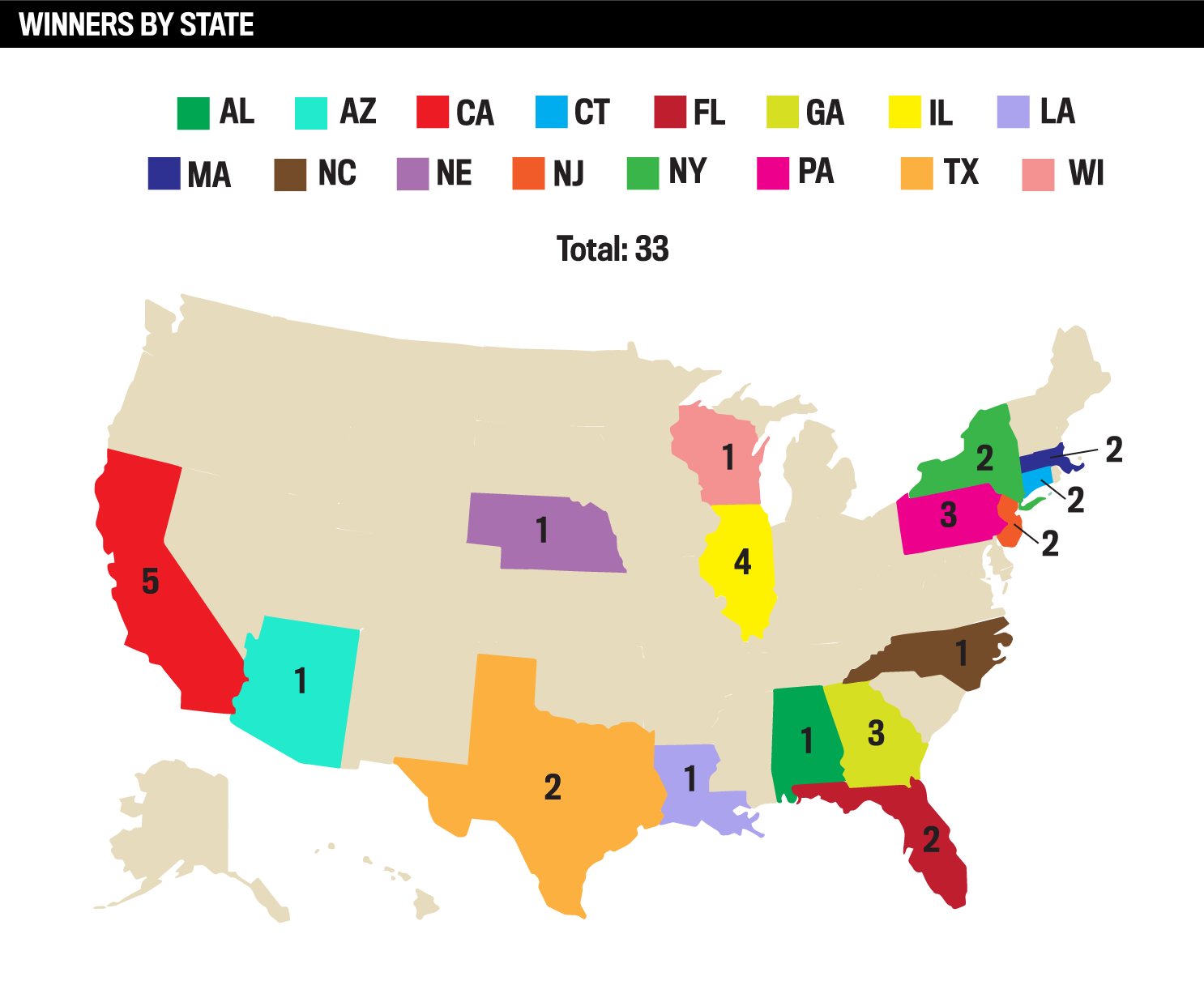

To narrow down the list to the final 33 Top Specialist Brokers, the IBA team reviewed all nominations, examining how each individual had made a meaningful contribution to the industry.

Keep up with the latest news and events

Join our mailing list, it’s free!