-2.jpg)

Updated Oct. 7, 2022

A managing general agent (MGA) or a managing general underwriter (MGU) is a specialized type of insurance agent or broker that has been granted underwriting authority by an insurer, and can administer programs and negotiate contracts for an insurer.

An MGA’s functions can include:

All of which are typically carried out by insurers. At its core, the MGA manages all or part of the insurance business of an insurer and acts as an insurance agent or broker for the insurer, while working as the intermediary between carriers and agents, and/or insureds.

Wholesale brokers act as an intermediary between a retail broker and an insurer, and work with insurers to attain specialized coverage for clients while having no contact with the insured. An MGA is one type of wholesale broker, and operates on the insurer’s behalf while also working closely with clients to attend to their needs.

The other type of wholesaler is a surplus lines broker who works with a retail agent and an insurer to obtain coverage for the insured. What makes MGAs unique is their binding authority from the insurer.

An MGA will deliver and service a carrier’s product to both insurance agencies and clients. MGAs can work with several carriers to formulate a specific mix of products to deliver to agents/brokers or directly to insureds.

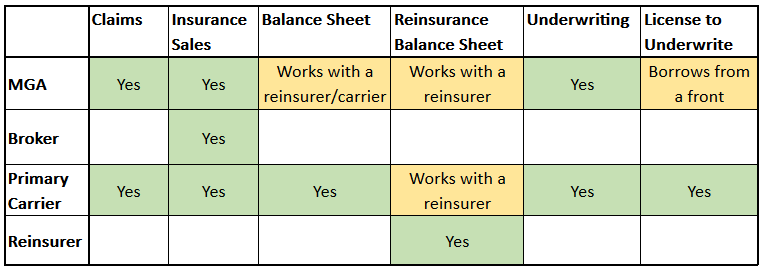

Here's a photo which could help the more visual among us understand how they compare:

Working with MGAs is beneficial to insurers because they possess expertise that insurers may not have in their head or regional offices, and which can be costly to develop in-house. Here are a number of ways that insurers can benefit from working with an MGA:

MGAs also bring technology to the table, such as online platforms that integrate with wholesale channels or products that speed up the quoting process, that help independent agents provide better services to their clients. Agents can realize higher commissions by working with an MGA that has a diverse network of carriers, allowing agents to review the commission structure and have the option to sell carriers’ products that offer the best rates. Here's the MGAA, a non-profit group, talking about some of the tech used:

Want to see some of the best MGAs in the business? See our 5-star MGAs for 2022.

Many MGA models were created during the 1990s and 2000s, though the role of the wholesale broker, a category that MGAs fall into, dates back to the 19th century. Associations that represent MGAs in specific regions today include:

In Australia and New Zealand, MGAs are referred to as underwriting agencies, though they have the same functions as managing general agencies. EY revealed that these agencies made up 13% of the broker market in Australia in 2016. According to the UAC, its 116 members account for more than AU$6 billion of premiums spent by Australian businesses and consumers annually.

In the UK, the term ‘MGA’ has been adopted by the market to refer to what was once known as a ‘coverholder.’ Today, more than 300 MGAs underwrite over 10% of the UK’s £47 billion general insurance market premiums, according to the MGAA.

Worldwide, MGAs fall into one of the fastest-growing segments of the insurance industry. Global investment firm Conning reported that MGA and program market growth continues to outpace the growth of the property and casualty market, with direct premium growth of 7% higher than the previous year compared to the 5% seen in P/C market growth. The analysis also showed that 21 of the top 25 P/C insurers have relationships with MGAs.

With technology bridging the gap between insurers and clients today, some carriers are moving away from relying on MGAs, which has thrown the identity and future of the MGA into question.

“By virtue, MGUs and MGAs, program administrators, are the middlemen,” said Rekha Schipper, president of Tangram Insurance Services. “How can we make sure we stay ahead, make sure that we take advantage, and make sure that we continue to be relevant and meaningful to a broker, to a carrier, to a tech investor, to say, this entity still belongs in the middle of all of this?”

However, an MGA is a natural outlet for technology solutions to plug into because of its established distribution channels. These agencies can also react to market changes quicker than typical insurance companies because they are smaller businesses that are acting on behalf of larger carriers.

“We can bring programs to the market faster. We can get out to more brokers because they can get on our platform. We can reduce our expenses as an MGU because now we’re automating a lot of things,” explained Schipper, adding that there’s “an unprecedented opportunity” for partnerships between technology vendors and MGUs.

During hard market periods, MGAs can be used by insurers to decrease costs and increase profitability. The MGA model is also flexible. Following the 2008 financial crisis, Ironshore, a Liberty Mutual company, established its managing general underwriting agency as its commercial clients were facing heightened risk since the viability of some insurance carriers that offered high coverage limits across many lines of business for major companies was uncertain. Brokers were meanwhile also under pressure to find alternative coverage solutions. The Ironshore MGU model involved underwriting as well as claims management, the latter of which made it unique from a traditional MGA, which can have limited authority on claims management and payment.

Have you had an experience with an MGA you'd like to share? Our comment section below is ready for it!