The primary purpose of life insurance is to help grieving families soften the financial impact of losing a loved one. With the right policy, this form of coverage can help families pay off loans and debts, as well as provide them with the financial means to meet daily living expenses.

Whole life insurance is among the most popular types of life coverage. Apart from providing the beneficiaries with a death benefit, this form of permanent life insurance comes with a savings component that the policyholders can tap into.

In this article, Insurance Business delves deeper into this form of coverage. We will discuss how this type of policy works, its benefits and drawbacks, and how it compares to other kinds of life insurance plans. This is part of our client education series. We encourage our normal readers of insurance professionals to pass this along to clients.

Whole life insurance combines lifetime coverage with a cash value component that the life insured can access while they are still alive. Almost all types of permanent life policies operate this way. What separates whole life insurance from other types of life insurance is that it provides a guaranteed minimum rate of return on the cash value.

According to the Insurance Information Institute (Triple-I), whole life insurance is the most popular form of permanent life coverage. Life insurance is also one of the most popular types of insurance that people take out.

Whole life insurance offers coverage for the entire lifetime of the insured – as long as regular premium payments are met – and pays out a guaranteed amount at the time of their death. There are two main types of whole life plans:

Most whole life insurance policies operate with level premiums, meaning the rates remain the same for the duration of the policy. Some plans follow a limited payment structure where the insured pays higher premiums in the first few years of the policy before the rates go lower in the latter years. Others adopt a modified premium model, which works the opposite, imposing lower premiums early in the policy before rates increase.

A portion of these premiums goes to the policy’s savings component, allowing it to accumulate cash value on a tax-deferred basis over time. The insured can access this amount in three ways:

One thing to note is that by surrendering the policy, it effectively terminates the plan, so this should only be done if the policyholder no longer needs coverage or if they have a new life insurance plan in place.

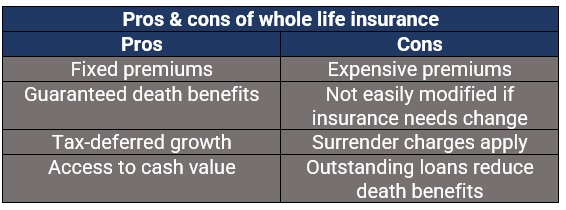

One of the main advantages of taking out a whole life insurance plan is that it can be used as a financial tool to accumulate wealth. Here are some of the benefits of this type of permanent life policy:

The main drawback of whole life insurance is the price. Premiums are typically more expensive compared to those of other types of life insurance policies. Compared to those for term life plans, for instance, the rates for whole life policies can be up to 15 times more expensive for the same death benefit.

Another disadvantage is that policyholders cannot easily end the policy. If they realize that they no longer need the coverage or cannot afford the monthly payments, insurers may impose a surrender charge should they decide to walk away from the plan. The amount is usually 10% of the cash value, depending on how far along they are with the policy, but decreases as the years go by.

In addition, if the insured decides to tap into the policy’s cash value and fails to pay back the loan, this can reduce the death benefit amount.

Here’s a summary of the pros and cons of a whole life insurance policy.

A whole life plan’s cash value operates the same way as a retirement savings account. Both allow the value to build up on a tax-deferred basis.

As the portion of the premiums that go towards the policy’s cash value grows, the insureds can borrow against or withdraw from the accumulated amount. Typically, the cash value builds up faster the younger the policyholder is and slows down as they grow older due to the increased risks associated with age.

Policyholders can tap into the cash value and use it for whatever they deem necessary, including as monthly premium payments to their whole life insurance plans. One thing to note is that any outstanding loans and withdrawals can reduce the amount their beneficiaries are set to receive.

However, most whole life insurance plans only pay out the death benefit, regardless of how much cash value the policy has accumulated over the years. Often used as a way for insurers to minimize risk, this amount reverts to them at the time of the insured’s death – unless the policyholder purchases a special type of rider that gives the beneficiaries ownership of the accumulated cash value. More on this later.

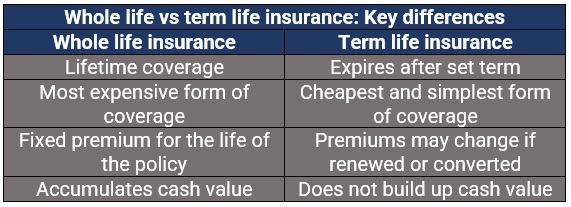

Despite being in the same insurance category, term life and whole life policies have several key differences. Here are some of them:

Unlike whole life policies, which provide lifetime coverage, term life insurance covers the policyholder for a set term, usually 10, 15, 20, and 30 years – the longest plan that one can take out. It pays out the benefit if the insured dies within the specified period, meaning they can only access the payment in the years that the policy is active.

Premiums for term life plans also tend to be lower as it is more likely that the policyholder will outlive the policy. Term life insurance, however, can be renewed or converted into a permanent life plan.

Term life policies do not accumulate cash value, unlike whole life insurance. This means the insured cannot borrow against their policies or get any cash value back if they cancel.

The table below summarizes the key differences between whole life and term life coverage.

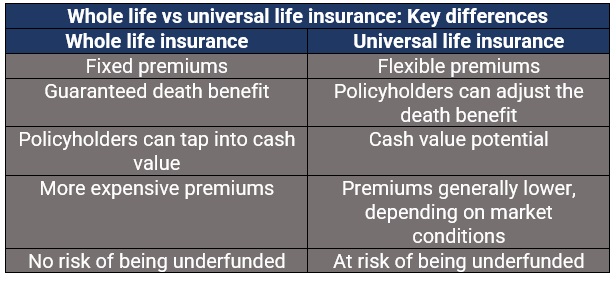

Permanent life insurance plans come in two main types – whole life insurance and universal life insurance. While both types of policies have key similarities – like providing lifetime coverage and combining the death benefit with a savings component – there are also major differences. These include:

Unlike whole life plans where premiums stay the same for the duration of the policy, universal life insurance uses a flexible premium structure, which the policyholder can adjust depending on their coverage needs. This, however, is subject to certain limits. That is why this type of coverage is also called adjustable life insurance.

While the cash value in whole life plans provide guaranteed returns, the returns for universal life insurance are based on how the market performs. The main drawback of this is that it can result in the plan becoming underfunded. This, in turn, can cause premiums to rise significantly and if not paid, can lead to the termination of the policy.

The table below sums up the key differences between whole life and universal life insurance.

Compared to those for a term life policy, whole life insurance premiums can be significantly more expensive. An analysis done by the comparison website Finder of annual insurance rates reveals a difference of thousands of dollars between a term life and a whole life plan.

Just like other types of life insurance, premiums for whole life policies are impacted by a range of factors, including:

Additionally, the cost of a whole life insurance policy can be influenced by the following:

Life insurance companies offer a range of add-ons that policyholders can purchase to access extra coverage and help them make the most out of their insurance policies. These riders come with corresponding costs. Here are some add-ons available for whole life insurance policyholders.

Whether whole life insurance is worth it depends on a person’s goals and circumstances. For those who value predictability, a whole life insurance policy may be worth considering as it offers permanent coverage with premiums that stay the same regardless of a person’s age or health status. It also builds cash value over time that policyholders can tap into to pay for medical bills or other expenses.

What about you? Do you think whole life insurance is worth considering? Do you have an experience about permanent life policies that you want to share? Use the comments section below for your thoughts.