Elite Women 2022

Jump to winners | Jump to methodology

Rising to new heights

The 85 winners of the 2022 IBA Elite Women awards are leaning in to further improve the conditions of women in insurance. Whether it was juggling work and home responsibilities during the pandemic or focusing on the complexities illuminated through intersectionality or breaking glass ceilings and ending pay disparities, these women are ascending to new heights but making sure to leave the ladder down to enable the next generation of women to climb up as well.

“Equity and belonging are part of the definition, and equity is not only pay equity, it’s opportunity. Understanding equity is what will allow and accelerate opportunities for growth”

Barbara Bufkin, Amwins Access Insurance Services

Women’s challenges – past, present and future

Panelist Barbara Bufkin, a senior advisor at Amwins Access Insurance Services, notes that over the past few years people in general and women in particular were faced with healthcare crises, supply chain issues, and food insecurities, as well as challenges to facilitate online learning for children and care for elderly parents – all of this in addition to having to learn how to do work remotely. “Being in the insurance industry relies heavily on relationship building and face-to-face interactions, so learning to transition to virtual meetings involved a learning curve as well,” she says. “Through resilience and fierce commitment our businesses grew, and relationships thrived.”

The global co-head of cyber at Reinsurance Solutions, panelist Catherine Mulligan says the pandemic burnout across many professions is well documented – especially with minorities. “Women of color, especially Black women, experience extra symptoms from the ‘emotional tax,’ a term which describes the debilitating impact of intersectionality in homogeneous workplaces,” she says. “The gender conversation must be deeply, intentionally intersectional for it to produce any meaningful results.”

A 2022 IBA Elite Women award winner, Elisa Stampf, co-founder and CEO at Ensure Equality, notes that pay equity discrepancies and work-life challenges have been difficult on women. “We place a lot of responsibility on women – both at work and home,” she says. “Recent studies showed that women left their jobs in droves over the pandemic to be home with their children during schooling or transition to a position that allowed for more balance. While these issues cannot be solved overnight, as an industry, we can make moves to ensure that insurance is both an attractive industry and one that honors the fact that we have more in our lives than just our jobs.”

Fellow winner Lenika P Milne, a national sales and marketing director at One80 Intermediaries, echoes Stampf’s sentiment. “Historically, women have been the primary caregivers in their families, and throughout the pandemic, women have shouldered a disproportionate share of its burden given the uncertainty around childcare and in-person instruction for school-aged children,” she says. “The One80 business launched in January 2020 just two months before the COVID-19 outbreak changed the world, requiring the company to grow and develop an inclusive culture through innovative ways of working and advanced technologies. As a result, we have built a platform that promotes and celebrates female talent while fostering an environment where every employee is supported and encouraged to become the best version of themselves each day.”

So, what do they expect in the near future?

Going forward, Bufkin cites the challenge of returning to work. People in insurance want to return to professional communities and this could be difficult with lingering pandemic issues such as childcare challenges and random school closings.

Mulligan says women accounted for only 11% of named executive offer positions and 19% of board seats at insurance companies before the pandemic, so now is the time to take more drastic action. “McKinsey estimated that ‘taking action now to advance gender equality could be valuable, adding $13 trillion to the global GDP in 2030 compared with the gender-regressive scenario’ currently in motion,” she says. “I don’t know what the insurance industry’s portion of that $13 trillion is, but it sure feels like it ‘could be valuable’ indeed.”

Milne says: “As we come out of the pandemic, it will be important that our industry continues to leverage the new ways of working with a view to compensate women fairly for their work and improve access to jobs through family-friendly policies.”

“The gender conversation must be deeply, intentionally intersectional for it to produce any meaningful results”

Catherine Mulligan, Reinsurance Solutions

What’s a woman worth?

In 2022, a woman in finance and insurance is paid $0.77 for every $1 dollar a man makes, according to CNBC. In addition to such pay disparities, there is a lack of opportunity – a glass ceiling over the upper levels of advancement.

“Equity has become an important part of diversity and inclusion,” says Bufkin. “Equity and belonging are part of the definition, and equity is not only pay equity, it’s opportunity. Understanding equity is what will allow and accelerate opportunities for growth. Like all of these topics, this is a work in progress.”

Meanwhile, Stampf believes it’s such a hot topic because it’s a real issue. “Unconscious bias plays a big part as well as where women sit in the industry,” she says. “For an industry that has more women than men, we tend to see far fewer women in roles above middle management. Even more than that, we have to understand that our differences can be our strengths – in my experience, the industry has a clear idea of what it takes to be successful in each role. We have to open ourselves up to different ideas and approaches. When we do, that’s when we can truly grow and thrive.”

Mulligan thinks more research is needed to inform the proper action to be taken. “A deep and transparent analysis of pay gaps across all sectors of the industry, all job levels, all demographics, would provide an appropriate road map,” she says. “Closing the pay gap would have industry-wide benefits. The data show that a diverse workforce produces better results, which generate better compensation for all. Diversity informs request for proposal and initial public offering decisions, so we know that attracting, retaining and developing diverse talent is essential to our success with customers. This requires equitable pay, which is also something investors track.”

“Unconscious bias plays a big part as well as where women sit in the industry. For an industry that has more women than men, we tend to see far fewer women in roles above middle management”

Elisa Stampf, Insure Equality

What do panel members consider an Elite Woman?

What characterizes an Elite Woman in insurance? What are her professional accomplishments and contributions to the industry? What are her contributions to the advancement of diversity and inclusion? What other attributes would she have?

For Mulligan, the typical Elite Woman is forward-looking and takes bold steps to move strategies forward. She builds powerful teams while championing her colleagues. She is a demonstrated leader who fosters a culture of inclusion, which engenders collaboration and innovation. She harnesses this energy to deliver results, bringing creative solutions and products to her customers while creating value and growing revenue. In addition, she knows that diverse, inclusive teams deliver superior results. And her authenticity shines and guides her career development.

“Many times, what makes someone professionally accomplished does not fit into a standard ‘one-size-fits-all’ definition,” says Bufkin. “There are several successful women who are doing things that are outside the norm of what would be a traditional career path, and this is very exciting. Some women have demonstrated success by being in a company and rising up the corporate ladder over a 25-year period, and many are coming into the industry demonstrating their talent by blending entrepreneurialism, creativity, innovation, technical savvy and understanding how to navigate complex company environments. We’ve found that having a combination of business acumen and demonstrating a high emotional quotient also contribute to women’s professional accomplishments.”

“This person has demonstrated their passion for D&I, their ability to be an effective spokesperson, their exemplary leadership, and their humanity – all contributing to further D&I efforts within their personal and professional communities.

“These women range from having extraordinary personal life commitments to being triathletes or marathon runners or achieving advanced level degrees. Their attributes are defined by their personalities and what they enjoy doing in life. These are women that demonstrate their own persona.”

“Historically, women have been the primary caregivers in their families, and throughout the pandemic women have shouldered a disproportionate share of its burden given the uncertainty around childcare and in-person instruction for school-aged children”

Lenika P Milne, One80 Intermediaries

Elite Women 2022

- Alice Underwood

Global leader, Insurance Consulting and Technology

Willis Towers Watson - Amber Hamilton Gregg

In-House Trial Attorney

State Farm Insurance - Anna Manning

Chief Executive Officer

Reinsurance Group of America - Andrea DeField

Partner

Hunton Andrews Kurth LLP - Andrea Keenan

Executive Vice President and Chief Strategy Officer

AM Best - Aneisha Goldsmith

Vice President, Business Development

Atrium Underwriters - Ayesha West

Vice President, Head of Cyber Liability

Everest Insurance - Catherine (Cathy) Smith

Chief Risk and Underwriting Officer

Munich Re America Services - Christina Geller

Senior Vice President, National Financial Insurance Product Leader

Axis Insurance - Christine Williams

Global Specialty Products Leader, Commercial Risk Solutions

Global Leader for Financial Lines & Professional Services

Aon - Dawnmarie Black

Head of US Broker Practice

Lloyd’s - Elisa Stampf

President and CEO

Insure Equality - Fatima Dean

Director, Client Development

ReSource Pro - Gail Koziara Boudreaux

CEO and President

Anthem - Gail Wien

Head of People Engagement

Axis Capital - Jade Sullivan

Head of Innovation

SolePro - Janice Hamilton

Chief Accounting Officer and Controller

Ryan Specialty - Jen Tadin

Chief Growth Officer

Bold Penguin - Jennifer Ndong Smith

Business Development Manager

Chubb - Jessica Scelzi

Chief Commercial Officer

The Zebra - Julie Brown

President

San Diego Insurance Staffing - Karen Keniff

Vice President, Large and Complex Construction

CNA - Kathy Conley-Jones

President and CEO

The Conley Financial Group - Kerri Roberts

Chief Operating Officer and Chief Marketing Officer

TIG Advisors and Sunstar Insurance Group - Kesa Edwards

HR Program Manager, Diversity and Inclusion

Farmers Insurance - Kim Beach

Founder and CEO

InsureWomen - Kirsten Charlton

Chief Global Business Services and Innovation Officer

Argo Group - LeAnne McCorry

CEO of Greater New York Region

Aon - Lisa Harris

Executive Vice President

CAC Specialty - Loretta Fuller

President and CEO

Insurance Solutions Associates - Martina Hahn

Chief Product Officer

The Zebra - Mary Parsons

Executive Vice President, North America PRS

Chubb - Megan Miller

Executive Director

Spencer Educational Foundation - Michelle Goldman

Executive Vice President

RT Specialty - Negar Sharifi

Commercial Vice President

AssuredPartners - Ngozi Nnaji

Founder

Ako Insurance Consulting - Oveta Mitchell

Vice President/Underwriting Lead, Primary Casualty

Axis Insurance - Patricia Gastanaga

Vice President, Property and Casualty

Brown & Brown - Precious Norman Walton

Director of Underwriting

Harbor AI - Rebekah Ratliff

Mediator/Arbitrator

JAMS - Robbyn Reichman

Managing Director and Global Specialty Claims Officer

Aon - Safiya Reid

Director, Diversity, Equity & Inclusion

PURE Insurance - Sophia Yen

Senior Partner/Principal, Insurance Strategy and Innovation Leader

EY - Stacie Gram

Vice President of Healthcare Claims

CNA - Stasi Bobo-Ligon

Strategic Relationship Leader for US National Accounts

Zurich North America - Stephanie Rushforth

Head of Underwriting Operations

Hiscox - Susan Johnson

Chief D&I Officer

The Hartford - Suzie Hall-Reynolds

Broker VP

MJ Hall & Company - Teresa Milano

Vice President, Management Liability

Woodruff Sawyer - Thais Moore

SVP, Director of Marketing and Communications

Lockton Companies - Tracey Sharis

SVP, Global Risk Solutions, North America Programs

Liberty Mutual

Methodology

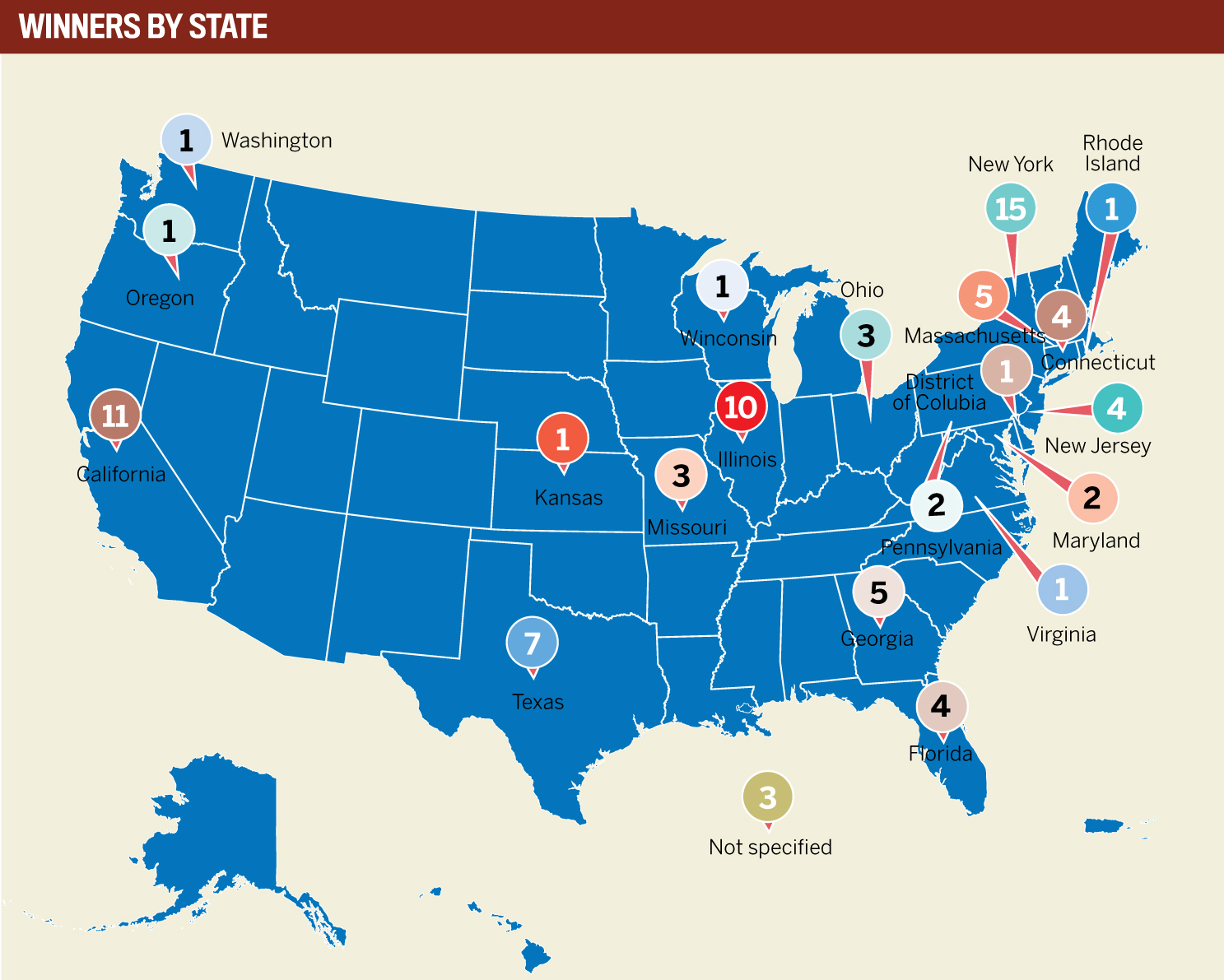

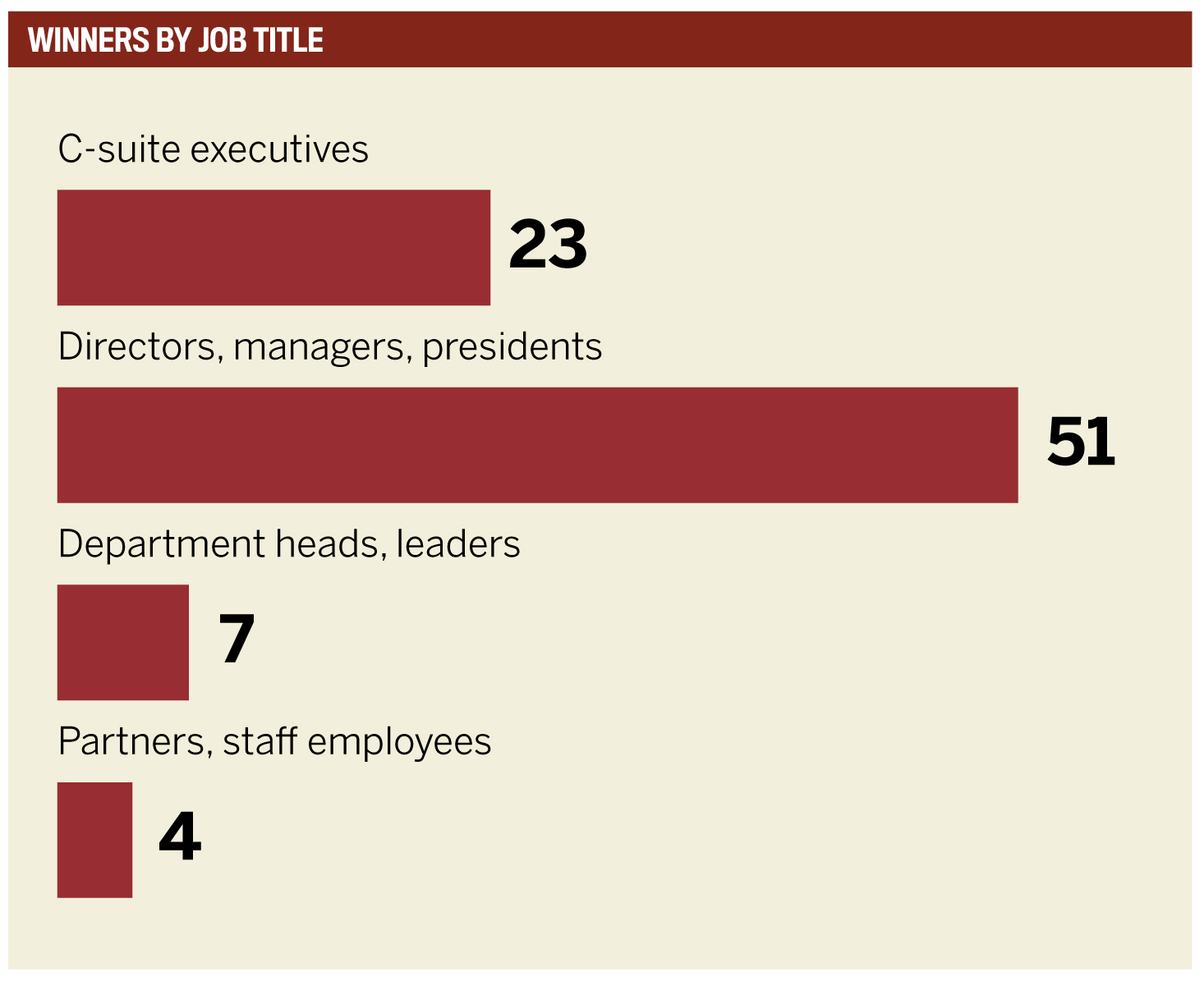

In February, Insurance Business America issued a call for nominations for this year’s Elite Women list. Nominators were asked to provide details of their nominee’s achievements and initiatives over the past 12 months, including specific examples of their professional accomplishments and contributions to the industry as a whole.

To select the winners, the IBA team relied on the help of an independent and esteemed panel of judges that included Barbara Bufkin at Amwins Access Insurance Services, Janet Jordan-Foster at Axis US Insurance, Michelle Lopilato at Converge, Catherine Mulligan at Aon – Reinsurance Solutions, and Deborah Fox at NFP Property & Casualty Services.

The judges and the IBA team reviewed all nominations, examining how each individual had made a meaningful contribution to the industry, to whittle down the list to the final 85 Elite Women. To avoid conflicts of interest, self-voting and voting for relatives were prohibited.

Introducing our esteemed panel of judges

Who best to judge our candidates for the 2022 IBA Elite Women awards than women who have been there, done that, and acquired a lifetime of achievements? This year’s panelists included a wide variety of great women with many accomplishments. A senior advisor at Amwins Access Insurance Services, Barbara C Bufkin not only has had a decades-long business career but also has worked with foundations and associations and established herself as a non-executive independent director. Deborah Fox is a vice president at NFP Property & Casualty Services, providing clients with creative solutions to reduce their workers’ compensation costs by leveraging her multi-jurisdictional knowledge and consulting experience. Janet Jordan-Foster is an executive vice president at Axis Insurance and chair of the National African American Insurance Association. Michelle Lopilato is head of distribution and founding member at Converge, a next-generation cyber insurance provider, and an insurance expert for cyber risk and technology E&O insurance products. The global co-head of cyber at Reinsurance Solutions, Catherine Mulligan has 25 years of experience in the (re)insurance industry, was a 2021 Woman to Watch, and is a passionate advocate of diversity, equity and inclusion.

Keep up with the latest news and events

Join our mailing list, it’s free!